Updated October 13, 2025

California ABC Test Explained: Are Your Contractors Actually Employees?

Did you know that misclassifying workers under the ABC test California courts now apply could cost your business up to $25,000 per violation?

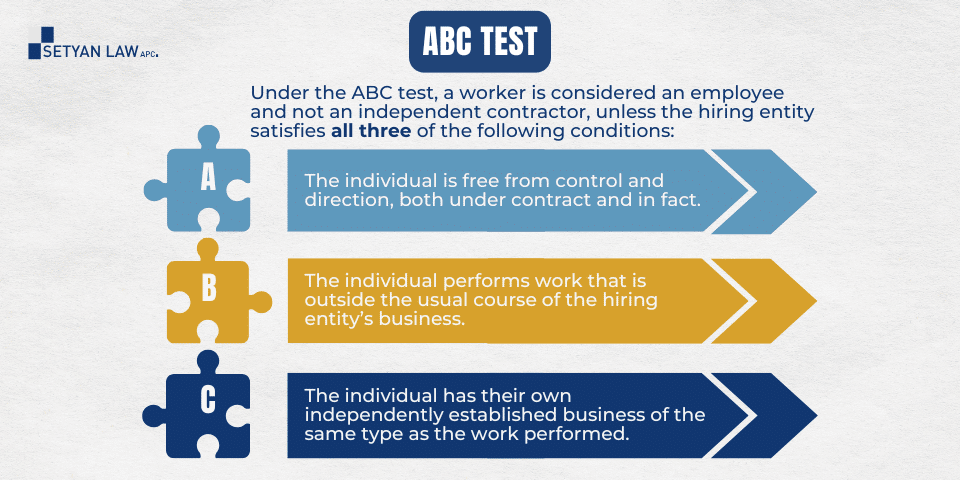

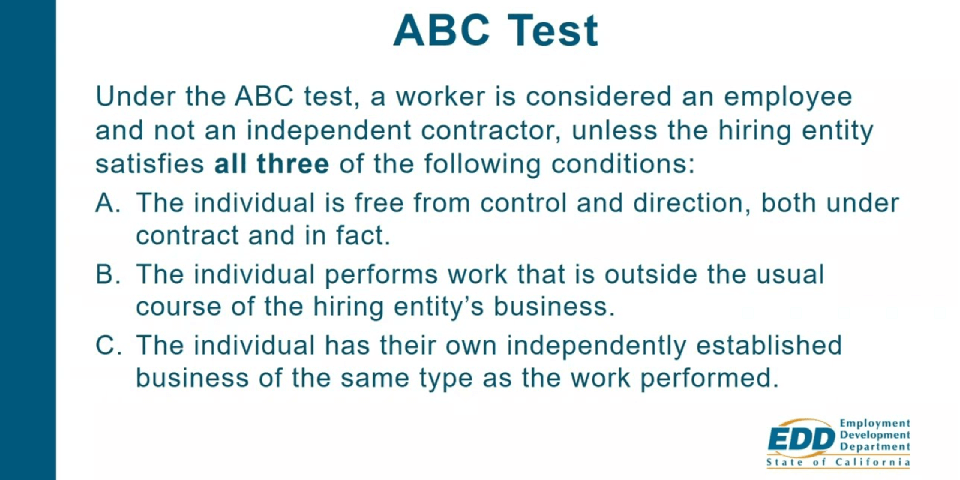

The ABC test has fundamentally changed how California determines whether a worker is an employee or an independent contractor. Since the landmark Dynamex decision and subsequent codification through AB5 and AB2257, many California businesses have discovered that workers they considered contractors are actually employees under the law. Consequently, companies face significant legal and financial risks when they misclassify workers, including substantial penalties, unpaid wage liabilities, and tax consequences.

Unlike previous classification methods, the ABC test creates a presumption that workers are employees unless the hiring entity can prove otherwise. Importantly, all three prongs of the test must be satisfied to classify a worker as an independent contractor. This stringent standard has forced many California businesses to reconsider their workforce arrangements and compliance strategies.

In this article, we'll break down exactly how the ABC test works, examine when it does and doesn't apply, and provide practical steps to ensure your business properly classifies workers. Whether you're a small business owner or HR professional, understanding these rules is essential for operating legally in California.

Understanding the ABC Test in California

California's ABC test fundamentally changes how worker classification works by starting with one critical legal assumption: nearly everyone who performs work for pay is an employee.

Presumption of Employee Status Under Labor Code 2775

Labor Code Section 2775(b)(1) explicitly states that "a person providing labor or services for remuneration shall be considered an employee rather than an independent contractor" . This language establishes a default position that workers are employees first, with independent contractor status being the exception rather than the rule. The code applies this presumption broadly across multiple legal frameworks, specifically "for purposes of this code and the Unemployment Insurance Code, and for the purposes of wage orders of the Industrial Welfare Commission" .

This approach represents a dramatic shift from earlier classification methods that evaluated various factors without a predetermined bias toward employment status. The ABC test starts with the assumption of an employment relationship, thus creating a higher threshold for businesses to overcome .

Burden of Proof on the Hiring Entity

Under the ABC test, the responsibility lies entirely with the hiring business to prove that a worker is properly classified as an independent contractor . Furthermore, the hiring entity must demonstrate that the relationship satisfies all three parts of the test simultaneously .

The law doesn't allow for partial compliance or balancing factors against each other. If a company fails to establish even one prong of the test, the worker automatically defaults to employee status . This all-or-nothing approach makes proper classification significantly more challenging than previous methods.

Additionally, this burden cannot be avoided through contractual language alone. The hiring entity cannot simply assign the "independent contractor" label or require workers to sign agreements designating themselves as independent contractors . Both the contractual arrangement and the actual working relationship must satisfy all three ABC criteria .

Comparison with IRS and Common Law Tests

The ABC test provides a starker contrast when compared to other classification methods:

The IRS test uses 20 different factors focused primarily on control without a presumption of employment status . This multi-factor approach gives businesses more flexibility in classification determinations.

The Common Law test employs 10 factors derived from court decisions over time, which has been criticized for being "overly subjective and open to manipulation" .

The Economic Realities test under the Fair Labor Standards Act uses six factors examining whether a worker is economically dependent on the employer .

One particularly notable distinction is that both the IRS and Common Law tests evaluate multiple factors without requiring that all criteria be met. Moreover, these tests allow for balancing various elements rather than the ABC test's strict "all three prongs" requirement .

Importantly, it's possible for a worker to be classified as an independent contractor under federal tests while simultaneously qualifying as an employee under California's ABC test . This creates compliance challenges for businesses operating across multiple jurisdictions.

The ABC test has been described as a "strong, protective, pro-employee test" specifically designed to "streamline the process for workers to prove they are employees who have been misclassified" .

Breaking Down the Three-Prong ABC Test

To properly classify workers as independent contractors under California law, businesses must satisfy all three prongs of the ABC test. Each prong has specific criteria that must be met, and failure on even a single requirement results in the worker being classified as an employee. Let's examine each component in detail.

Prong A: Freedom from Control in Practice and Contract

Prong A requires that workers be "free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract for the performance of the work and in fact" . Importantly, this freedom must exist both on paper and in actual practice.

The California Supreme Court clarified in Dynamex that a worker subject to "the type and degree of control a business typically exercises over employees" fails this prong . However, businesses need not control every precise detail of the work to fail this test. Even maintaining the "necessary control that an employer ordinarily possesses" is sufficient to classify someone as an employee .

Prong B: Work Outside the Usual Course of Business

Prong B examines whether "the worker performs work that is outside the usual course of the hiring entity's business" . This requirement often poses the greatest challenge for businesses.

According to the Dynamex decision, contracted workers who provide services comparable to existing employees will typically be considered employees themselves . Clear examples where Prong B is satisfied include:

- A retail store hiring an outside plumber to repair a bathroom leak

- A retail store hiring an outside electrician to install a new electrical line

Conversely, examples where Prong B fails include:

- A clothing manufacturer hiring at-home seamstresses to make dresses from company-supplied materials

- A bakery hiring cake decorators to regularly work on custom-designed cakes

Prong C: Independently Established Trade or Business

Prong C requires proof that "the worker is customarily engaged in an independently established trade, occupation, or business of the same nature as that involved in the work performed" .

Notably, the independent business must "actually exist at the time the work is performed" . Future possibilities or potential for independent business are insufficient . Courts look for tangible evidence of an established business, such as:

- Incorporation or formal business establishment

- Licensure and relevant permits

- Advertisements and marketing materials

- Routine offerings to multiple potential customers

Simply labeling a worker as an "independent contractor" in contracts or requiring them to sign agreements with this designation does not satisfy this prong . Additionally, if a worker's business relies on a single employer, Prong C generally fails. For instance, courts ruled against independent contractor status for taxi drivers required to hold municipal permits usable only while employed by a specific taxi company .

Examples from Dynamex and Subsequent Cases

The Dynamex case and subsequent rulings provide practical illustrations of the ABC test's application. In one case, a company failed Prong A because it provided at-home knitters with patterns, maintaining control over production despite workers completing tasks at home .

Conversely, a construction company successfully established Prong A when a historic reconstruction specialist set his own schedule, worked without supervision, purchased materials independently, and had declined an employment offer from the company .

Despite these examples, courts have emphasized that meeting all three prongs remains challenging. Indeed, the California Supreme Court intended this test to "significantly broaden the definition of 'employee'" , making it substantially more difficult to classify workers as independent contractors than under previous standards.

When the ABC Test Does Not Apply

While the ABC test creates a strict standard for worker classification in California, certain exceptions allow businesses to use the more flexible Borello test instead. Understanding these exemptions is crucial for determining your compliance obligations.

Occupational Exemptions Under AB 2257

AB 2257 significantly expanded the list of occupations exempt from the ABC test. These professions fall back to the Borello standard and include:

- Licensed professionals such as insurance agents, physicians, attorneys, architects, engineers, accountants, and private investigators

- Creative professionals including recording artists, songwriters, musicians, fine artists, photographers, and certain freelance writers

- Service providers such as manicurists (until January 1, 2025), barbers, estheticians, and electrologists who meet specific independence criteria

- Specialized roles like competition judges, appraisers, registered professional foresters, and manufactured housing salespersons

The entertainment industry received particular attention, with exemptions for recording artists, musicians performing single-engagement live performances (with exceptions for large venues and orchestras), and individual performance artists creating original work, including comedians, magicians, and storytellers.

Business-to-Business and Referral Agency Exceptions

The business-to-business exemption applies when one business entity contracts with another to provide services. For this exemption, the contractor must demonstrate all of the following conditions are met:

- The service provider operates independently from the hiring entity's control

- The contract is in writing

- The provider maintains required licenses and permits

- The provider maintains a separate business location

- The provider offers similar services to other businesses

Likewise, the referral agency exemption applies to businesses that connect clients with service providers for graphic design, photography, tutoring, event planning, and other specified services. Importantly, this exemption excludes high-hazard industries, janitorial work, delivery, transportation, and construction services beyond minor home repair.

Fallback to the Borello Test: Totality of Circumstances

When the ABC test doesn't apply, classification falls back to the Borello "totality of circumstances" test. Unlike the ABC test's all-or-nothing approach, Borello considers multiple factors holistically, with no single element being determinative.

Key Borello factors include:

- Whether the worker has the right to control how the work is performed

- Whether the worker is engaged in a distinct occupation or business

- Whether the worker supplies tools and equipment

- Whether payment is by time or by job completion

Essentially, the Borello test offers more flexibility as workers can be classified as independent contractors even if they fail some individual factors, provided the overall relationship suggests independence. This stands in stark contrast to the ABC test's requirement that all three prongs must be satisfied.

Legal and Financial Risks of Misclassification

Misclassifying workers carries substantial financial and legal consequences that extend far beyond administrative headaches. The risks of non-compliance with California's ABC test can seriously impact your business's bottom line and legal standing.

Civil Penalties: $5,000 to $25,000 per Violation

The financial stakes for misclassification are extraordinarily high in California. Under Labor Code Section 226.8, employers face civil penalties ranging from $5,000 to $15,000 for each willful misclassification . Henceforth, if authorities determine a pattern or practice of violations exists, these penalties escalate dramatically to between $10,000 and $25,000 per violation . Afterward, these fines apply regardless of company size – even businesses with just 10 misclassified workers could face six-figure penalties.

Colorado similarly imposes penalties starting at $5,000 per misclassified employee, jumping to $25,000 for repeat violations . Throughout numerous states, comparable financial penalties have been implemented, making misclassification a nationwide compliance concern.

Unpaid Wages, Benefits, and Tax Liabilities

Beyond immediate penalties, misclassification creates substantial retroactive liabilities. Businesses must pay back wages, including minimum wage deficiencies and overtime compensation dating back two years (or three years for willful violations) . In addition, employers become responsible for both halves of Social Security and Medicare contributions that should have been paid .

Moreover, misclassified workers may be entitled to retroactive benefits including health insurance, retirement contributions, and paid leave . The financial impact compounds rapidly as these unplanned liabilities accumulate across multiple workers and pay periods.

Impact on Workers' Compensation and Unemployment Insurance

Proper classification directly affects insurance coverage and related liabilities. First, misclassified workers are ineligible for workers' compensation when injured on the job . Given that misclassification removes this protection, the business becomes solely responsible for any workplace injuries, creating potentially unlimited liability outside insurance coverage .

Similarly, misclassification prevents workers from accessing unemployment insurance benefits . Although the precise financial impact varies, the California Department of Labor Standards Enforcement estimates misclassification creates a staggering $7 billion shortage in the state's social safety net systems .

Plus, businesses may face additional audits from multiple agencies simultaneously. Once flagged for misclassification, companies often experience heightened scrutiny from the IRS, Department of Labor, and state agencies, creating ongoing administrative and compliance burdens .

Steps to Ensure Proper Worker Classification

Proactive compliance with worker classification rules demands systematic evaluation and adjustment of your business practices. Taking preventative steps now can help you avoid the costly penalties associated with misclassification.

Conducting Internal Audits Using ABC Criteria

Begin by conducting thorough internal audits of your workforce. The federal budget has proposed funding for 4,700 additional investigations into worker misclassification issues . During your audit, evaluate each worker's status individually, as a one-size-fits-all approach often leads to misclassification . Consider these key questions:

- Does your company control the means and methods of work or merely the result?

- How, when, and where does the worker perform their tasks?

- Who provides the equipment and materials?

- Are the services traditionally performed by employees?

Perform these reviews both at the outset of new working relationships and periodically thereafter to ensure ongoing compliance .

Updating Contracts and Work Arrangements

Many businesses mistakenly believe that labeling someone an independent contractor in a contract resolves the classification issue . In reality, contract language alone cannot determine worker status . Forthwith update your agreements to accurately reflect the actual working relationship while removing elements suggesting employer control.

Review all existing documents for problematic language that might inadvertently suggest an employment relationship . Remember that California authorities examine the substance of the relationship beyond what's written on paper.

When to Seek Legal Counsel for Classification Review

Consider consulting with an employment attorney before making classification decisions, especially given rising enforcement. The Economic Policy Institute found that misclassified workers lose between $19,000 to $21,000 annually in pay and benefits .

Straightaway seek legal guidance whenever:

- You're unsure which test applies (ABC vs. Borello)

- Your business operates in high-risk industries like construction or trucking

- You're contemplating reclassifying existing workers

Ultimately, legal counsel can conduct classification reviews under attorney-client privilege, helping identify issues before they become costly legal problems .

Conclusion

California's ABC test represents a pivotal shift in worker classification, fundamentally changing how businesses must approach their contractor relationships. This stringent three-prong standard requires companies to satisfy all criteria simultaneously – demonstrating freedom from control, work outside the usual course of business, and proof of an independently established trade. Failure to meet even one prong automatically defaults workers to employee status, creating substantial compliance challenges.

The financial stakes for misclassification remain extraordinarily high. Companies face civil penalties reaching $25,000 per violation, plus significant back-wage liabilities, unpaid benefits, and tax obligations. These consequences can quickly escalate into existential threats for businesses of any size.

Nevertheless, certain occupations qualify for exemptions under AB 2257, allowing the more flexible Borello test instead. Licensed professionals, creative workers, and specific business-to-business arrangements may fall outside the ABC test's scope. Still, these exceptions require careful navigation and often necessitate legal guidance to apply correctly.

Proactive compliance demands systematic evaluation of your workforce arrangements. Conducting thorough internal audits, updating contracts to accurately reflect working relationships, and seeking legal counsel before making classification decisions will help safeguard your business. Additionally, regular reviews ensure continued compliance as relationships evolve over time.

The landscape for California businesses has undeniably transformed since Dynamex and subsequent legislation. While classification challenges have increased, understanding precisely how the ABC test works empowers companies to make informed decisions about their workforce structure. Ultimately, proper worker classification protects both your business and the workers who contribute to its success.

References

[1] – https://www.hunton.com/hunton-employment-labor-perspectives/conducting-internal-audits-to-ensure-employees-are-properly-classified

[2] – https://www.labor.ca.gov/employmentstatus/abctest/

[3] – https://www.akerman.com/en/perspectives/hrdef-say-goodbye-to-independent-contractors-the-new-abc-test-of-employee-status.html

[4] – https://www.epi.org/publication/misclassification-the-abc-test-and-employee-status-the-california-experience-and-its-relevance-to-current-policy-debates/

[5] – https://www.wrapbook.com/blog/worker-classification-tests-by-state

[6] – https://www.dir.ca.gov/dlse/faq_independentcontractor.htm

[7] – https://ponlaw.com/employers-focus-on-the-b-of-the-abc-test-when-analyzing-contractor-vs-employee-status-under-ab5/

[8] – https://www.sdcba.org/?pg=FTR-May-2018-3

[9] – https://www.shouselaw.com/ca/labor/labor-code-226-8/

[10] – https://www.hollandhart.com/articles/workermisclassificationposesseriousrisks.pdf

[11] – https://www.pillsburylaw.com/en/news-and-insights/dol-fair-labor-standards-act-contractors.html

[12] – https://www.dol.gov/agencies/whd/flsa/misclassification/myths/detail

[13] – https://www.darrow.ai/resources/penalties-for-misclassifying-employees-as-independent-contractors

[14] – https://www.usemultiplier.com/contractor-of-record/abc-test

[15] – https://www.mesrianilaw.com/blog/what-is-employment-misclassification/

[16] – https://www.sacattorneys.com/articles/top-mistakes-employers-make-when-classifying-workers-in-california/

[17] – https://www.lindabury.com/firm/insights/proposed-regulations-for-classification-of-independent-contractors-may-prove-to-be-problematic-for-employers.html

[18] – https://www.pbw-law.com/what-independent-contractors-need-to-know-about-californias-worker-classification-law/

If you need employment litigation, call Setyan Law at (213)-618-3655. Free consultation.