Updated January 26, 2026

`

California Assembly Bill 5 (AB 5): Are You Really an Independent Contractor?

Are you working as an independent contractor in California? California Assembly Bill 5 (AB 5) might drastically change your employment status—whether you know it or not.

Many workers who believe they're legitimate independent contractors are actually misclassified employees under this groundbreaking legislation. The distinction isn't merely a matter of paperwork or titles; it significantly affects your rights, benefits, and tax obligations.

Passed in 2019 and taking effect in January 2020, AB 5 fundamentally altered how worker classification happens in California. The law specifically codified the "ABC Test," making it much harder for companies to classify workers as independent contractors rather than employees. Consequently, thousands of California workers previously considered contractors now legally qualify as employees entitled to minimum wage, overtime pay, workers' compensation, and other benefits.

This guide explores everything you need to know about AB 5, including how to determine your proper classification under the current law. We'll examine the ABC Test criteria, important exceptions where it doesn't apply, alternative classification methods, and the serious implications of misclassification for both workers and employers.

What is California Assembly Bill 5 (AB 5)?

California Assembly Bill 5 (AB 5) represents a landmark shift in employment law that fundamentally altered how businesses classify workers throughout the state. Governor Gavin Newsom signed this pivotal legislation into law on September 18, 2019, with implementation beginning January 1, 2020 [1].

Background and purpose of AB 5

AB 5 emerged in response to growing concerns about worker misclassification across California's economy. In his signing statement, Governor Newsom described the legislation as "landmark legislation for workers and our economy" [2]. The bill's primary purpose was to combat the misclassification of workers as independent contractors when they should legally be classified as employees.

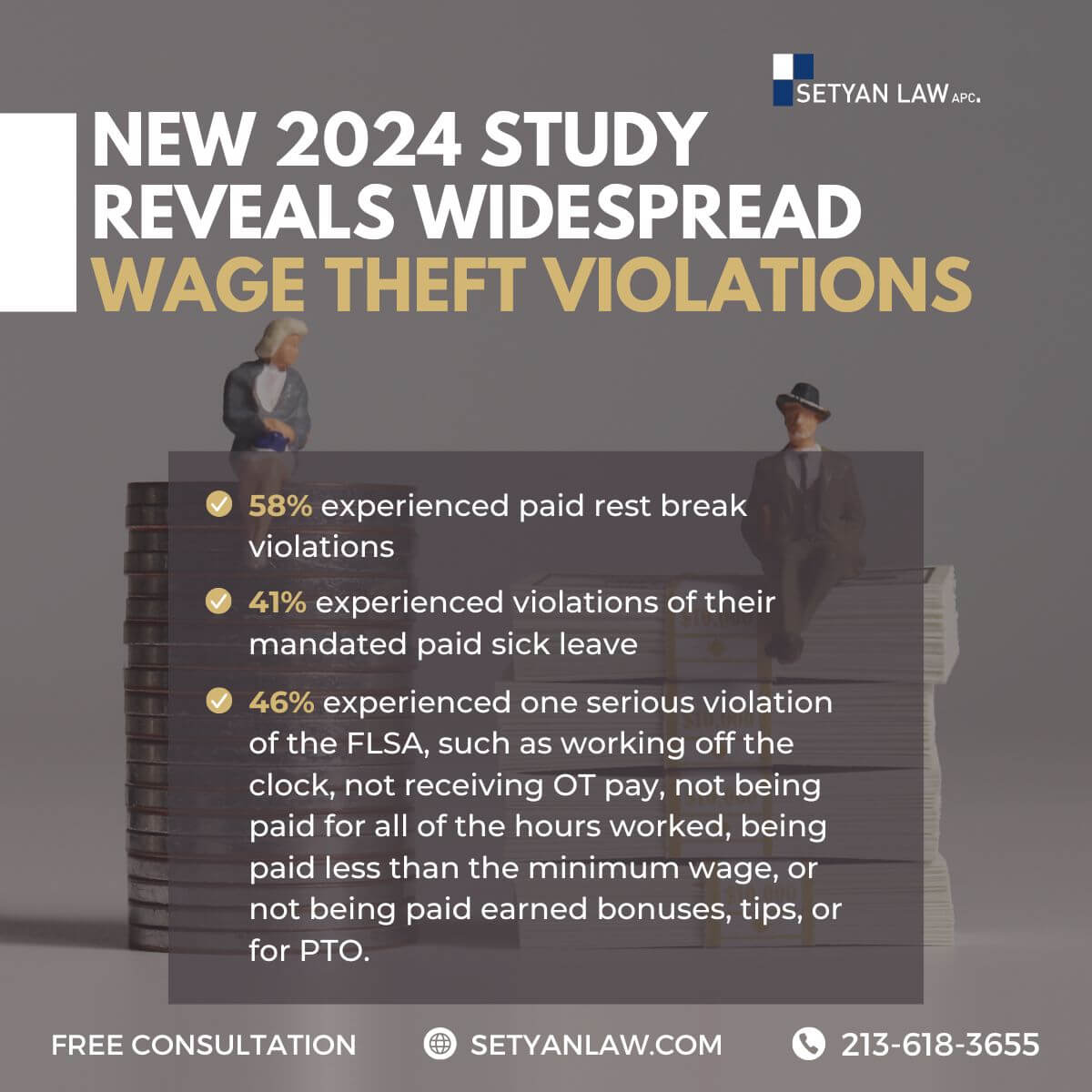

The legislation aimed to address situations where companies improperly classified workers to avoid providing basic labor protections and benefits. According to California's estimates, worker misclassification costs the state as much as $7 billion annually in lost tax revenue [3]. Furthermore, misclassified workers lose access to fundamental workplace protections including minimum wage guarantees, overtime pay, paid sick leave, and workers' compensation benefits.

How AB 5 changed worker classification laws

Before AB 5, California relied on multiple tests for determining employment status depending on the context. The new law established a consistent standard by adding Section 2750.3 (later recodified with modifications into Labor Code sections 2775-2787) [1].

The most substantial change was AB 5's codification and expansion of the "ABC test" beyond wage orders. While the Dynamex court decision (discussed below) applied the test only to Industrial Welfare Commission wage orders, AB 5 extended its application to all provisions of the Labor Code and Unemployment Insurance Code [2]. This expansion meant that workers previously classified as independent contractors could now qualify as employees entitled to a much broader range of protections and benefits.

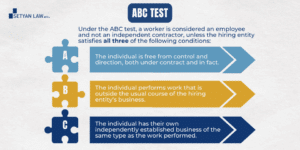

Under the ABC test, a worker is presumed to be an employee unless the hiring entity can prove all three of these conditions:

- Part A: The worker is free from control and direction of the hiring entity in connection with performing the work, both under contract and in fact.

- Part B: The worker performs work outside the usual course of the hiring entity's business.

- Part C: The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed [4].

The Dynamex decision and its influence

AB 5 didn't create the ABC test from scratch—instead, it codified a groundbreaking 2018 California Supreme Court decision. In Dynamex Operations West, Inc. v. Superior Court of Los Angeles County, the court unanimously established the ABC test as the appropriate standard for determining employment status under California wage orders [5].

The Dynamex decision represented a significant departure from the previously used "Borello test," which examined multiple factors with the primary focus on whether the hiring entity had the "right to control" how work was performed [6]. Additionally, the Dynamex ruling established a critical presumption that fundamentally shifted the burden of proof—all workers are presumed employees unless proven otherwise by the hiring entity [7].

In 2021, the California Supreme Court further solidified Dynamex's importance by ruling in Vazquez v. Jan-Pro Franchising International that the ABC test applied retroactively to cases not yet finalized when Dynamex was decided [8]. Through this evolving legal landscape, AB 5 stands as the formalized legislative response to Dynamex, creating a comprehensive framework that continues to reshape California's employment relationships.

Understanding the ABC Test

The cornerstone of AB 5 is the ABC test—a rigid three-part framework that presumes all workers are employees unless proven otherwise. Unlike previous classification methods, this test sets a high bar for independent contractor status by requiring companies to satisfy all three conditions simultaneously [3]. Failing even one prong automatically classifies the worker as an employee entitled to full labor protections.

Part A: Freedom from control

The first prong examines whether "the worker is free from the control and direction of the hiring entity in connection with the performance of the work, both under the contract and in fact" [4]. Essentially, this evaluates the company's level of supervision over how work gets done.

Control manifests in various ways. For instance, a trucking company demonstrated control when it required drivers to keep trucks clean, report to dispatch centers, and get approval before taking passengers [9]. Similarly, knitters working from home were classified as employees because they had to follow specific patterns despite setting their own hours [10].

Conversely, a historic restoration specialist qualified as an independent contractor under Part A because he set his own schedule, worked without supervision, used his own business debit card, and declined employment offers to maintain autonomy [10].

Notably, a company need not control every precise detail of work to fail this prong. Even partial control that resembles typical employer-employee relationships can be sufficient for worker classification [4]. The question ultimately centers on whether workers operate with genuine independence or remain under company direction.

Part B: Work outside usual business

The second prong requires that "the worker performs work that is outside the usual course of the hiring entity's business" [4]. This element often poses the greatest challenge for companies trying to classify workers as independent contractors [11].

To illustrate this concept:

- A bakery hiring cake decorators for custom designs would fail Part B since cake decoration is part of a bakery's core business [10]

- A retail store hiring a plumber to repair bathroom facilities would pass Part B since plumbing isn't part of retail operations [10]

- A clothing manufacturer hiring home-based seamstresses would fail Part B since clothing production is the company's primary business [4]

This prong effectively prevents businesses from outsourcing their central operations to independent contractors. If the worker's role resembles existing employees' functions or delivers services integral to the company's offerings, they're likely employees under this standard [11].

Part C: Independent trade or business

The third prong requires that "the worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed" [4]. This examines whether the worker genuinely operates an independent business outside the hiring entity.

For Part C, merely labeling someone an independent contractor is insufficient [4]. The business must prove the worker has taken concrete steps to establish their own enterprise, such as:

- Filing for incorporation or appropriate licenses

- Creating business cards and marketing materials

- Maintaining a separate business location or business phone number

- Actively promoting services to multiple clients [9]

Moreover, the independent business must already exist at the time work is performed—not merely as a future possibility [10]. A study by UC Berkeley estimated that 64% of workers who primarily do independent contracting would be categorized as employees under the ABC test [3].

Part C wasn't satisfied in a case where taxi drivers held municipal permits usable only while employed by specific taxi companies—demonstrating they weren't truly independent [4]. Similarly, siding installers failed Part C despite using their own tools because they lacked business indicators and received income solely from one construction company [9].

When the ABC Test Does Not Apply

While the ABC test serves as the primary standard for worker classification in California, numerous significant exceptions exist. Throughout California's Labor Code sections 2775-2787, lawmakers carved out specific situations where the ABC test doesn't apply.

Statutory exceptions under Labor Code

California law recognizes that the ABC test may not be appropriate in all contexts. In certain situations where the Legislature or Industrial Welfare Commission has defined employment relationships specifically, those definitions take precedence over the ABC test. Likewise, if a court determines the ABC test cannot apply due to federal preemption or other legal reasons, the alternative Borello test applies instead.

AB 2257, signed into law in September 2020, substantially expanded these exceptions by adding 109 categories of workers exempted from the ABC test in California. These amendments aimed to address concerns from various industries while preserving AB 5's core protections.

Occupations automatically using Borello

Several professions automatically default to the Borello test rather than facing the ABC test's stricter standards. These occupations include:

- Licensed insurance agents, brokers, and underwriters

- Licensed physicians, surgeons, dentists, podiatrists, psychologists, and veterinarians

- Licensed attorneys, architects, landscape architects, engineers, private investigators, and accountants

- Registered securities broker-dealers and investment advisers

- Direct sales salespersons who aren't paid hourly and have written contracts

- Commercial fishermen (exemption through December 31, 2025)

- Newspaper distributors and carriers (exemption through December 31, 2029)

- Manufactured housing salespersons

- Competition judges and home inspectors

For these professionals, classification determination reverts to the Borello multifactor test that primarily examines whether the hiring entity has control over how work gets performed.

Situations requiring additional conditions

Certain working relationships may qualify for Borello test evaluation, albeit only after meeting specific preliminary requirements. These include:

Professional services contractors providing marketing, HR administration, graphic design, photography, or similar services must maintain separate business locations, set their own rates, exercise independent judgment, and meet other conditions.

Business-to-business relationships can qualify when service providers formed as sole proprietorships, partnerships, LLCs, or corporations meet 12 specific conditions, including maintaining separate business locations and clientele.

Construction industry subcontractors may qualify if they have written contracts, appropriate licenses, separate business locations, and financial responsibility for errors.

Single-engagement events—defined as "stand-alone non-recurring events or series of events occurring no more than once weekly"—have their own exemption pathway when specific requirements are satisfied.

Noticeably absent from these exemptions, even after amendments, are app-based drivers, gig economy companies, and the motion picture industry, despite extensive lobbying efforts.

The Borello Test and How It Differs

Prior to the implementation of AB 5, California relied on a different standard for worker classification—the Borello test. Named after a 1989 California Supreme Court case, S.G. Borello & Sons, Inc. v. Department of Industrial Relations, this approach remains relevant today for exempt occupations and situations where the ABC test doesn't apply.

Overview of the multifactor approach

The Borello test employs a comprehensive balancing method that considers multiple factors holistically to determine worker status. Undoubtedly, this makes it more flexible than the ABC test's rigid structure [4]. Whereas the ABC test requires satisfaction of all three criteria, the Borello standard doesn't treat any single element as decisive [12]. Courts weigh all relevant circumstances on a case-by-case basis, evaluating the nature of the work, overall arrangement between parties, and purpose of the law [4]. As a result, two workers in seemingly similar situations might receive different classifications depending on their specific circumstances.

Key factors considered in Borello

The primary consideration in Borello is whether the hiring entity has the "right to control" the manner and means of work performance [13]. In addition, courts examine secondary factors including:

- Whether the worker operates a distinct business from the hiring entity

- If the work forms a regular or integral part of the company's operations

- Who provides tools, equipment, and work location

- The worker's investment in necessary materials

- Required skill level and supervision needs

- Opportunity for profit/loss based on managerial skill

- Service duration and relationship permanence

- Payment method (by time or by job)

- Parties' beliefs about their relationship [4]

When Borello is used instead of ABC

The Borello test applies primarily in these circumstances:

For statutorily exempt occupations including licensed professionals (physicians, attorneys, accountants), insurance agents, direct salespeople, and certain creative professionals [14]

When the Legislature or Industrial Welfare Commission has specifically defined employment relationships differently [4]

In business-to-business, construction, and referral agency relationships meeting specific statutory criteria [15]

Where courts determine the ABC test cannot apply for legal reasons [4]

Importantly, qualifying for an exemption doesn't automatically make someone an independent contractor—it merely shifts which test applies [16]. The worker must still satisfy Borello's multifactor analysis.

Tax and Legal Implications of Misclassification

Misclassifying workers carries hefty financial consequences for both employers and workers. Beyond legal compliance issues, the tax and financial implications can be substantial and far-reaching.

Tax reporting differences (W-2 vs 1099)

Proper classification determines how income gets reported to tax authorities. Employees receive W-2 forms with taxes already withheld, whereas independent contractors receive 1099 forms with no withholding [17]. This distinction significantly impacts tax responsibilities. For employees, employers must withhold federal and state income taxes, state disability insurance tax, and the employee's share of Social Security and Medicare taxes [17]. Alternatively, independent contractors bear the full burden of self-employment tax, covering both employer and employee portions of Social Security and Medicare contributions [3].

Penalties for employers

Employers who misclassify workers face severe consequences. Civil penalties for willful misclassification (defined as voluntarily and knowingly misclassifying an employee) range from $5,000 to $15,000 per violation [18]. These penalties increase to $10,000-$25,000 per violation when employers demonstrate a pattern of misclassification [18]. Coupled with these penalties, employers may owe back wages, unpaid payroll taxes, and interest [4]. Notably, California estimates annual tax revenue losses from misclassification at approximately $7 billion [3].

Loss of benefits for workers

Misclassified workers lose numerous critical protections including:

- Minimum wage and overtime pay provisions

- Workers' compensation coverage for job-related injuries

- Unemployment insurance benefits

- Paid sick days and family leave

- Protection from workplace discrimination and harassment [19]

Typically, independent contractors earn about $24,000 less annually in benefits compared to properly classified employees [20]. Even seemingly "flexible" contractor arrangements often come at tremendous cost to workers' financial security and legal protections [19].

Conclusion

California Assembly Bill 5 has fundamentally transformed the employment landscape since its 2020 implementation. Throughout this article, we've examined how AB 5 codified the ABC test, creating a much stricter standard for classifying workers as independent contractors rather than employees. This legislation represents a significant shift away from the previously used Borello test, which still applies only in specific exempt situations.

The consequences of proper classification extend far beyond mere paperwork. Workers classified as employees gain access to crucial benefits including minimum wage protection, overtime pay, workers' compensation, and unemployment insurance. Meanwhile, companies face substantial penalties for misclassification—ranging from $5,000 to $25,000 per violation, plus potential back wages and unpaid taxes.

Understanding your true employment status under AB 5 requires careful analysis of all three ABC test prongs. You must demonstrate freedom from company control, work outside the hiring entity's usual business, and maintain an independently established occupation. Failing even one prong automatically classifies you as an employee entitled to full labor protections.

The distinctions between W-2 employees and 1099 contractors carry significant tax implications for both parties. Employees benefit from employer tax withholding, while contractors shoulder the full burden of self-employment taxes—typically resulting in thousands of dollars less in annual take-home pay and benefits.

Before accepting any independent contractor position in California, evaluate whether your working relationship truly satisfies all ABC test requirements or qualifies for a specific statutory exemption. This careful assessment protects you from potential benefit losses and helps hiring companies avoid costly penalties. The financial security and legal protections at stake make proper classification essential for everyone involved in California's workforce.

If you’re employed by a California employer, contact an expert Wrongful Termination Attorney first, for expert assistance regarding your case. Call today for a free and confidential consultation.