Updated November 4, 2025

Understanding California Labor Code 1197

California Labor Code Section 1197 is a pivotal regulation that establishes the minimum wage standards for employees across the state. This law is crucial for ensuring fair compensation for workers and protecting their rights in the workplace. In this article, we will delve into the specifics of California Labor Code 1197, its implications, and how it affects both employees and employers.

Overview of California Labor Code 1197

California Labor Code 1197 explicitly states that the minimum wage for employees, as determined by the commission or any applicable state or local law, is the lowest wage that can be legally paid to workers. Paying less than this established minimum wage is considered unlawful. This section also clarifies that local minimum wage laws remain applicable and enforceable, meaning that if a city or county has set a higher minimum wage, employers must comply with those local regulations.

Key Provisions of Section 1197

- Minimum Wage Requirement: Employers are mandated to pay their employees at least the minimum wage set by state or local laws.

- Local Laws: The law does not override local minimum wage ordinances, allowing cities and counties to establish higher wage standards.

- Unlawful Payments: Any payment below the minimum wage is illegal, providing a basis for employees to seek redress.

Current Minimum Wage in California

As of 2025, the minimum wage in California is set at $16.50 per hour. This figure represents the statewide baseline; however, various localities have enacted their own minimum wage laws that exceed this amount. For instance, cities like San Francisco and Los Angeles have established higher minimum wages to account for the increased cost of living in those areas.

Comparison with Federal Minimum Wage

California’s minimum wage is significantly higher than the federal minimum wage, which stands at $7.25 per hour. This disparity highlights California’s commitment to ensuring that workers receive a living wage that reflects the state’s economic conditions.

Employee Rights Under Labor Code 1197

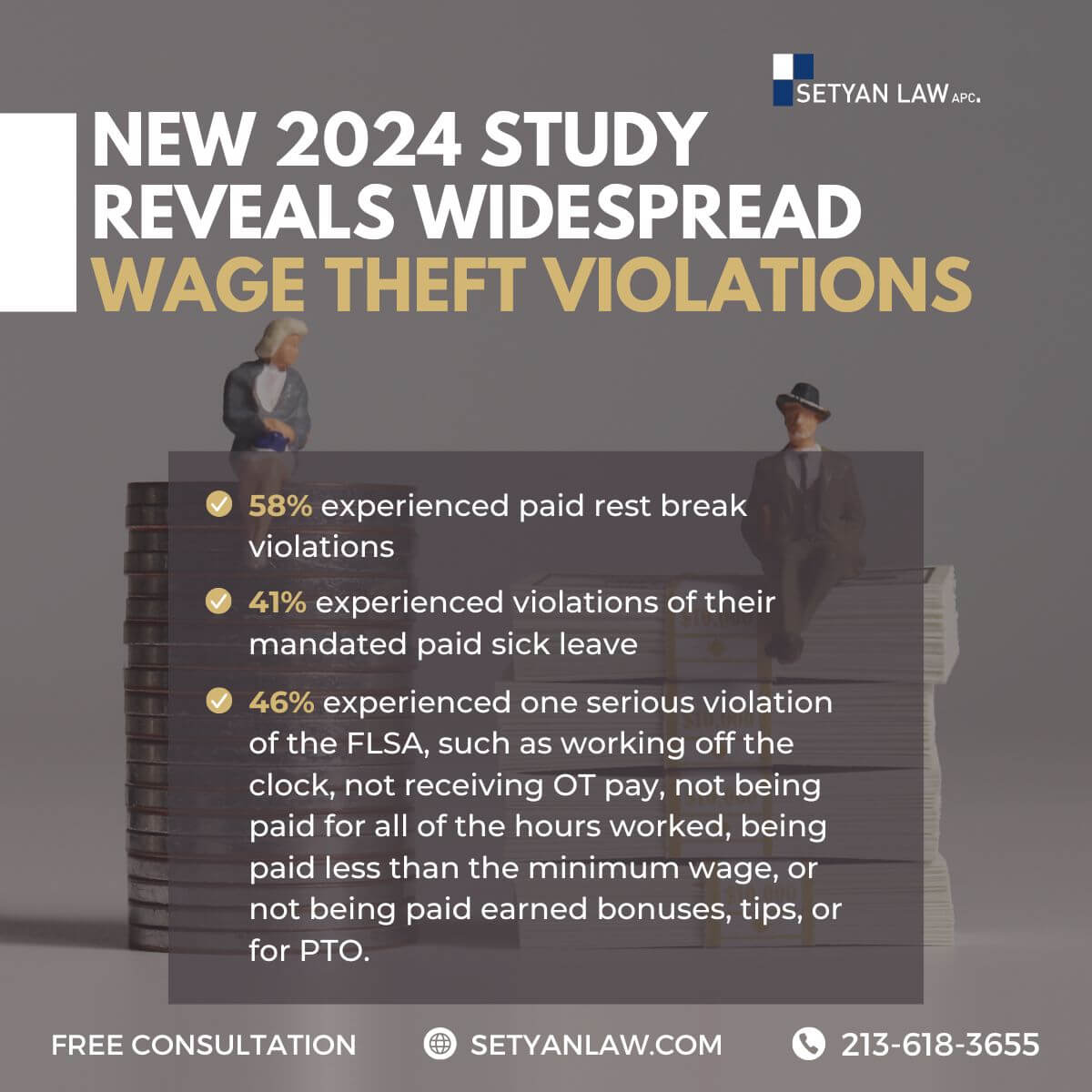

Employees have the right to receive at least the minimum wage for all hours worked. This right is fundamental to labor law in California and is designed to protect workers from exploitation. If an employee believes they are being paid less than the minimum wage, they have several options for recourse.

Filing a Complaint

Employees who suspect they are being underpaid can file a complaint with the California Labor Commissioner’s Office. This office is responsible for enforcing labor laws and can investigate claims of wage theft or violations of minimum wage laws.

Legal Action

In addition to filing a complaint, employees may also pursue legal action against their employers. If successful, they may recover unpaid wages, interest, and potentially attorney’s fees. This legal avenue serves as a critical tool for employees seeking justice for wage violations.

Exceptions to Minimum Wage Requirements

While California Labor Code 1197 establishes clear minimum wage standards, there are specific exceptions where certain employees may not be entitled to the minimum wage. Understanding these exceptions is essential for both employees and employers.

Categories of Exceptions

- Outside Salespeople: Employees who spend more than 50% of their work time away from the employer’s premises selling goods or services.

- Student Employees: Individuals working in certain educational programs or internships.

- Camp Counselors: Employees working at organized camps, typically during the summer months.

- National Service Program Participants: Individuals engaged in national service programs.

- Individuals with Disabilities: Employees who are mentally or physically handicapped and work for authorized nonprofit organizations or rehabilitation facilities.

- Independent Contractors: Those classified as independent contractors rather than employees.

Local Minimum Wage Laws

California’s labor landscape is further complicated by the existence of local minimum wage laws. Many cities have enacted ordinances that set minimum wages higher than the state standard. Employers operating in these areas must adhere to the local regulations.

Examples of Local Minimum Wage Rates

- San Francisco: As of 2025, the minimum wage is $20 per hour.

- Los Angeles: The minimum wage is set at $16.78 per hour.

- Berkeley: The minimum wage is $17.50 per hour.

These local laws reflect the varying economic conditions across California and aim to provide workers with a wage that meets the cost of living in their respective areas.

Implications for Employers

Employers must be vigilant in ensuring compliance with California Labor Code 1197 and any applicable local wage laws. Failure to adhere to these regulations can result in significant legal consequences, including fines and lawsuits.

Best Practices for Employers

- Regular Wage Audits: Conduct periodic audits of employee wages to ensure compliance with minimum wage laws.

- Training and Education: Provide training for management and HR personnel on wage laws and employee rights.

- Clear Record-Keeping: Maintain accurate records of hours worked and wages paid to employees.

- Consult Legal Counsel: Seek legal advice when establishing wage policies to ensure compliance with both state and local laws.

The Role of Legal Counsel

Navigating the complexities of California Labor Code 1197 can be challenging for both employees and employers. Legal counsel can provide invaluable assistance in understanding rights and obligations under the law.

When to Seek Legal Help

- For Employees: If you believe your employer is violating minimum wage laws, consulting with an employment attorney can help you understand your rights and options.

- For Employers: Legal counsel can assist in developing compliant wage policies and addressing any potential violations before they escalate.

Conclusion

California Labor Code 1197 plays a crucial role in protecting the rights of employees by establishing minimum wage standards. Understanding this law is essential for both workers and employers to ensure compliance and promote fair labor practices. If you have questions about your rights under this law or need assistance navigating wage issues, consider reaching out to a qualified employment attorney for guidance.

Call Setyan Law at (213)-618-3655 to schedule a free consultation.