Updated November 16, 2025

Understanding California Labor Code 201

California Labor Code 201 is a crucial piece of legislation that governs the payment of wages to employees upon termination of employment. This law ensures that employees receive their earned wages promptly, whether they are discharged or resign. Understanding the nuances of this code is essential for both employees and employers to navigate the complexities of wage payments effectively.

Immediate Payment Upon Discharge

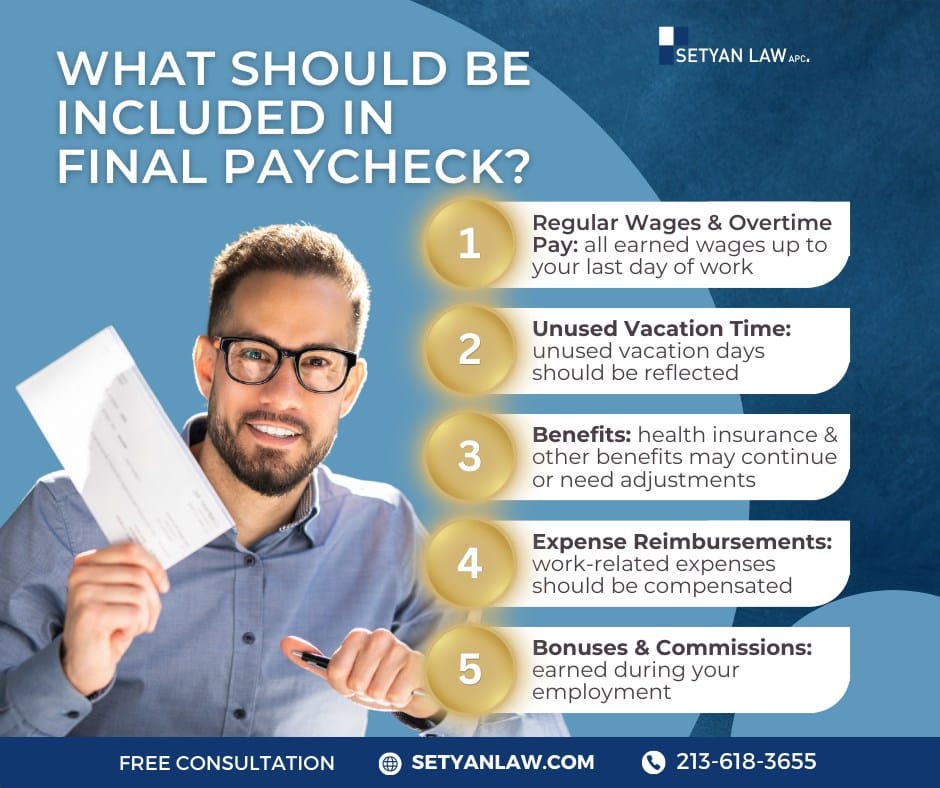

When an employee is terminated, California Labor Code 201 mandates that all earned and unpaid wages must be paid immediately. This includes not only the regular wages for hours worked but also any accrued vacation time or bonuses that may be owed. The law emphasizes the importance of timely payment, as delays can lead to significant penalties for employers.

Key Points:

- Immediate Payment: Employees must receive their final paycheck at the time of discharge.

- Inclusion of Accrued Benefits: Final wages must include any unused vacation or holiday pay.

- Penalties for Non-Compliance: Employers who fail to comply may face legal repercussions.

Special Considerations for Seasonal Employees

California Labor Code 201 recognizes that certain industries, particularly those involving seasonal employment, may require different handling of final wage payments. For employees in sectors such as canning, drying, or curing perishable goods, employers are allowed a grace period of up to 72 hours to process and deliver final wages.

Important Details:

- 72-Hour Rule: Employers have a maximum of 72 hours to pay seasonal employees after discharge.

- Reasonable Timeframe: This period is intended to allow employers sufficient time to calculate and process wages accurately.

- Mailing Option: If requested, employers must send the final paycheck via mail to the employee’s designated address.

Employee Rights Regarding Unused Leave

In addition to immediate payment for wages, California Labor Code 201 also addresses the treatment of unused leave. Employees may have the option to defer payment for any unused vacation, annual leave, or holiday pay into the next calendar year, allowing them to contribute these amounts to retirement accounts such as 401(k), 403(b), or 457 plans.

Options for Employees:

- Full Contribution: Employees can choose to contribute the entire unused leave payment to their retirement account.

- Partial Cash Payment: Employees may opt to receive a portion of the unused leave as cash while deferring the rest to their retirement account.

- Lump-Sum Payment: Alternatively, employees can request a lump-sum payment for all unused leave.

Resignation and Final Paychecks

The rules governing final paychecks differ slightly depending on whether an employee resigns voluntarily or is terminated. If an employee provides at least 72 hours’ notice before quitting, they are entitled to receive their final paycheck on their last working day. However, if an employee quits without notice, the employer has up to 72 hours to issue the final payment.

Summary of Resignation Rules:

- With Notice: Final paycheck is due on the last day of work.

- Without Notice: Employers have 72 hours to pay the final wages.

- Accrued Leave: Unused vacation or leave must also be included in the final paycheck.

Consequences of Delayed Payments

Employers who fail to pay final wages on time may face severe penalties under California Labor Code 203. For each day that wages remain unpaid beyond the required timeframe, employees can accrue waiting time penalties, which are equivalent to their daily wage. This penalty can accumulate for up to 30 days, significantly increasing the financial burden on the employer.

Penalty Structure:

- Daily Accrual: Employees earn their regular wages for each day their final paycheck is delayed.

- Maximum Duration: Penalties can accumulate for a maximum of 30 days.

- Good Faith Defense: Employers may defend against penalties by proving a legitimate dispute over the owed wages.

Filing a Claim for Unpaid Wages

If an employee believes their final paycheck has been unlawfully withheld, they have several options for recourse. They can file a wage claim with the California Division of Labor Standards Enforcement (DLSE) or pursue legal action against their employer. It is crucial for employees to gather relevant documentation, such as pay stubs and employment records, to support their claims.

Steps to Take:

- Gather Documentation: Collect pay stubs, employment contracts, and any correspondence related to wage disputes.

- File a Wage Claim: Submit a claim to the DLSE online, by mail, or in person.

- Consider Legal Action: If necessary, consult with an employment attorney to explore the possibility of filing a lawsuit.

The Importance of Legal Guidance

Navigating the complexities of California Labor Code 201 can be challenging for both employees and employers. Seeking legal advice can provide clarity on rights and obligations under the law. Employment attorneys can assist in understanding the implications of wage laws and help enforce employee rights effectively.

Benefits of Legal Support:

- Expert Guidance: Attorneys can clarify legal rights and obligations.

- Representation: Legal professionals can represent employees in disputes with employers.

- Peace of Mind: Having legal support can alleviate stress during employment transitions.

Conclusion

California Labor Code 201 plays a vital role in protecting employee rights regarding wage payments upon termination. Understanding the provisions of this law is essential for both employees and employers to ensure compliance and avoid potential penalties. By being informed about their rights, employees can take proactive steps to secure their earned wages and seek legal recourse if necessary.

If you find yourself facing issues related to unpaid wages or final paychecks, consider reaching out to a qualified employment attorney who can guide you through the process and help you assert your rights effectively.

If you need employment litigation, call Setyan Law at (213)-618-3655. Free consultation.