Updated November 16, 2025

Understanding California Labor Code 202

California Labor Code 202 is a crucial piece of legislation that outlines the rights of employees regarding their final wages upon resignation. This law is particularly significant for workers who do not have a written contract specifying the duration of their employment. Understanding the nuances of this law can empower employees to ensure they receive the compensation they are entitled to when they leave their jobs.

Labor Code 202 stipulates the timeline for when employees must receive their final wages after quitting. The law differentiates between employees who provide notice of their resignation and those who do not.

Key Provisions

- Notice Requirement: If an employee gives at least 72 hours’ notice before quitting, they are entitled to receive their final paycheck on their last working day.

- No Notice: If an employee resigns without providing the required notice, their employer has up to 72 hours to issue the final paycheck.

- Payment Method: Employees who quit without notice can request that their final wages be mailed to a designated address, and the employer must comply within the 72-hour timeframe.

These provisions ensure that employees are compensated fairly and promptly, regardless of their circumstances surrounding their departure.

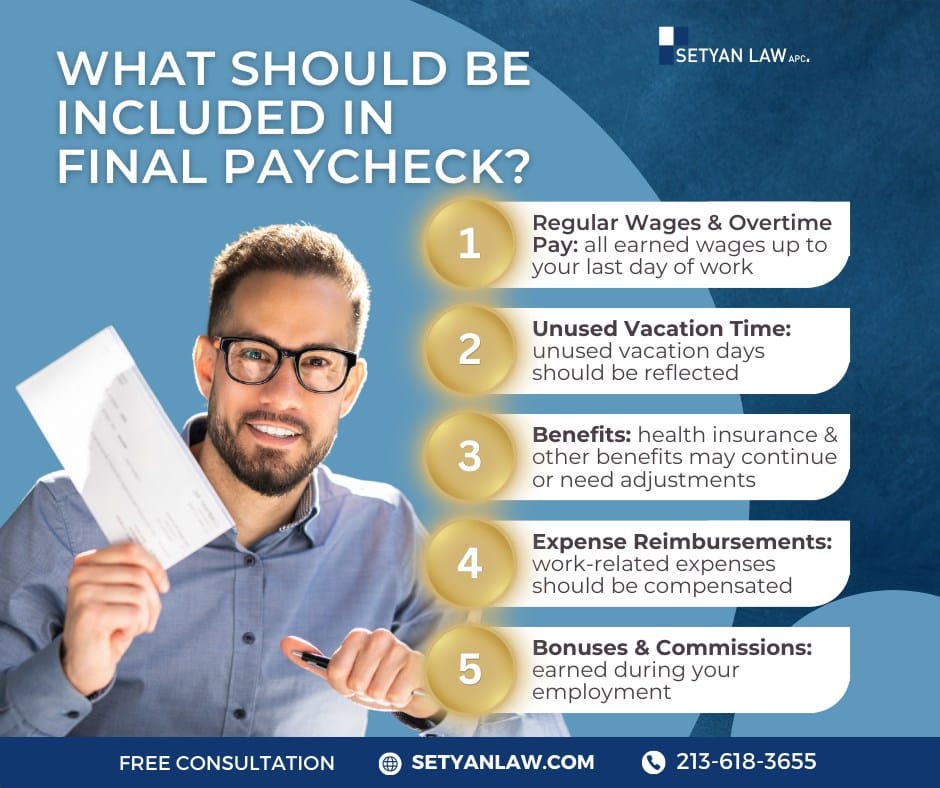

Final Paycheck: What It Includes

When discussing final paychecks, it is essential to understand what constitutes "final wages." Under California law, this includes not only the unpaid wages for hours worked but also any accrued benefits.

Components of Final Wages

- Unpaid Regular Wages: This includes all hours worked up to the last day of employment.

- Accrued Vacation Time: Employees are entitled to payment for any unused vacation days.

- Sick Leave: If applicable, any accrued sick leave must also be compensated.

- Bonuses: Any earned bonuses that have not yet been paid should be included in the final paycheck.

Employers must ensure that all these components are accounted for to comply with Labor Code 202.

Implications of Quitting Without Notice

Quitting without providing the required notice can have implications for how quickly an employee receives their final paycheck.

Consequences of No Notice

- Extended Payment Timeline: Employees who do not give 72 hours’ notice must wait up to 72 hours after their resignation to receive their final wages.

- Mailing Option: Employees can request that their final paycheck be mailed, which can provide convenience but may also delay receipt depending on postal service times.

Understanding these consequences can help employees make informed decisions about their resignation process.

Employer Obligations Under Labor Code 202

Employers have specific obligations under Labor Code 202 that they must adhere to when an employee resigns.

Immediate Payment Upon Termination

If an employee is terminated or laid off, the employer is required to provide the final paycheck immediately. This is a critical distinction from the rules governing voluntary resignations.

Penalties for Non-Compliance

If an employer fails to pay the final wages within the stipulated timeframes, they may face penalties.

- Waiting Time Penalties: Employers can be penalized for each day the wages remain unpaid, up to a maximum of 30 days. This penalty is calculated based on the employee’s daily wage rate.

These penalties serve as a deterrent against employers who might otherwise delay payment.

Exceptions to Labor Code 202

While Labor Code 202 provides clear guidelines, there are exceptions that employees should be aware of.

Specific Industries

Certain industries, such as motion picture and agriculture, may have different rules regarding the timing of final wage payments. Employees in these sectors should consult their specific industry regulations to understand their rights fully.

Seasonal Workers

Seasonal workers may also have different provisions under California Labor Code 201, which governs the payment of wages for employees who are discharged.

How to Handle Delayed Payments

If an employee does not receive their final paycheck on time, there are steps they can take to address the situation.

Filing a Wage Claim

Employees can file a claim with the California Division of Labor Standards Enforcement (DLSE) if their final wages are not paid within the required timeframe.

Legal Action

In cases of significant delays or disputes, employees may consider pursuing legal action against their employer. Consulting with an employment attorney can provide guidance on the best course of action.

Importance of Documentation

Maintaining thorough documentation is essential for employees who may need to assert their rights under Labor Code 202.

Keeping Records

- Pay Stubs: Employees should keep copies of their pay stubs to track hours worked and wages earned.

- Resignation Notice: If notice is given, keeping a copy of the resignation letter can serve as proof of compliance with the notice requirement.

- Communication Records: Documenting any communications with the employer regarding the final paycheck can be beneficial if disputes arise.

These records can be invaluable in supporting an employee’s claims regarding unpaid wages.

Seeking Legal Assistance

Navigating the complexities of Labor Code 202 can be challenging, especially if disputes arise.

When to Consult an Attorney

Employees should consider consulting with an employment attorney if they encounter issues such as:

- Delayed payment of final wages

- Disputes over the amount owed

- Retaliation from the employer for asserting their rights

An attorney can provide valuable guidance and representation to ensure that employees receive the compensation they are entitled to.

Conclusion

California Labor Code 202 is a vital law that protects employees’ rights regarding their final wages upon resignation. Understanding the provisions of this law can empower employees to ensure they are compensated fairly and promptly. By being aware of their rights, maintaining proper documentation, and seeking legal assistance when necessary, employees can navigate the complexities of employment law with confidence.

If you need employment litigation, call Setyan Law at (213)-618-3655. Free consultation.