Updated November 3, 2025

California Labor Code 226: Employee Rights and Employer Obligations

California Labor Code 226 is a crucial piece of legislation that outlines the rights of employees regarding wage statements. This law mandates that employers provide their employees with detailed itemized wage statements, ensuring transparency in wage payments and deductions. Understanding this code is essential for both employees and employers to navigate the complexities of wage-related issues effectively.

Overview of California Labor Code 226

California Labor Code 226 requires employers to furnish employees with itemized wage statements at least twice a month or on each payday. These statements must include specific information that allows employees to understand their earnings and deductions clearly. The law aims to protect employees by ensuring they have access to accurate information about their wages.

Key Components of Wage Statements

The wage statements provided under California Labor Code 226 must include the following essential elements:

- Gross Wages: The total amount earned before any deductions.

- Net Wages: The amount received after all deductions have been made.

- Deductions: A detailed list of all deductions taken from the gross wages, such as taxes and benefits.

- Pay Period Dates: The inclusive dates for which the wages are being paid.

- Hours Worked: For non-exempt employees, the total hours worked during the pay period.

- Employee Information: The employee’s name and the last four digits of their Social Security number.

- Employer Information: The name and address of the employer.

- Hourly Rates: The applicable hourly rates and the number of hours worked at each rate.

These components ensure that employees are well-informed about their earnings and can easily identify any discrepancies.

Legal Implications of Non-Compliance

Employers who fail to comply with California Labor Code 226 face significant legal repercussions. If an employee does not receive a valid wage statement, they are entitled to compensation. The penalties for non-compliance include:

- Initial Violation: An employee can claim $50 for the first pay period in which a violation occurs.

- Subsequent Violations: For each additional violation, the employee can claim $100, with a maximum aggregate penalty of $4,000.

- Legal Fees: If an employee takes legal action to recover damages, the employer may also be responsible for covering court costs and attorney fees.

These penalties emphasize the importance of compliance for employers and the protection of employee rights.

Right to Inspect Records

California Labor Code 226 also grants employees the right to inspect their wage records. Employers must allow current and former employees to request copies of their wage statements and related records within 21 days of the request. Failure to comply with this request can result in a civil penalty of $750.

Exceptions to the Law

While California Labor Code 226 provides robust protections for employees, there are specific exceptions. For instance, the law does not apply to certain categories of workers, such as those employed by residential property owners for personal duties. Additionally, employees who are exempt from overtime pay may not be required to have their hours worked listed on their wage statements.

Understanding Exemptions

Exemptions under California Labor Code 226 include:

- Salaried Employees: Employees whose compensation is solely based on salary and who are exempt from overtime.

- Executive, Administrative, or Professional Roles: Certain positions that meet specific criteria set by the Industrial Welfare Commission.

- Outside Salespersons: Employees whose primary duties involve making sales outside of the employer’s place of business.

These exemptions highlight the need for employees to understand their classification and rights under the law.

The Importance of Accurate Wage Statements

Accurate wage statements are vital for maintaining trust between employers and employees. They provide transparency regarding compensation and deductions, allowing employees to verify their earnings and ensure they are being paid correctly. Moreover, clear wage statements can help prevent disputes and misunderstandings related to pay.

Employee Empowerment

By providing detailed wage statements, employers empower their employees to take control of their financial well-being. Employees can easily identify any discrepancies and address them promptly, fostering a culture of accountability and transparency in the workplace.

How to Address Wage Statement Issues

If an employee believes their employer has violated California Labor Code 226, there are several steps they can take:

- Review Wage Statements: Carefully examine wage statements for accuracy and completeness.

- Communicate with the Employer: Discuss any discrepancies with the employer or HR department to seek clarification.

- File a Complaint: If the issue remains unresolved, employees can file a complaint with the California Labor Commissioner’s Office.

- Seek Legal Counsel: Consulting with an employment attorney can provide guidance on potential legal actions and remedies.

Taking Action

Employees should not hesitate to take action if they believe their rights have been violated. Understanding California Labor Code 226 empowers employees to advocate for themselves and seek the compensation they deserve.

Conclusion

California Labor Code 226 plays a vital role in protecting employee rights by ensuring transparency in wage payments. Employers must comply with the law by providing accurate and detailed wage statements to their employees. By understanding their rights under this code, employees can take proactive steps to address any issues related to their wages and hold their employers accountable. If you have questions or concerns about your wage statements, consider reaching out to a legal professional for assistance.

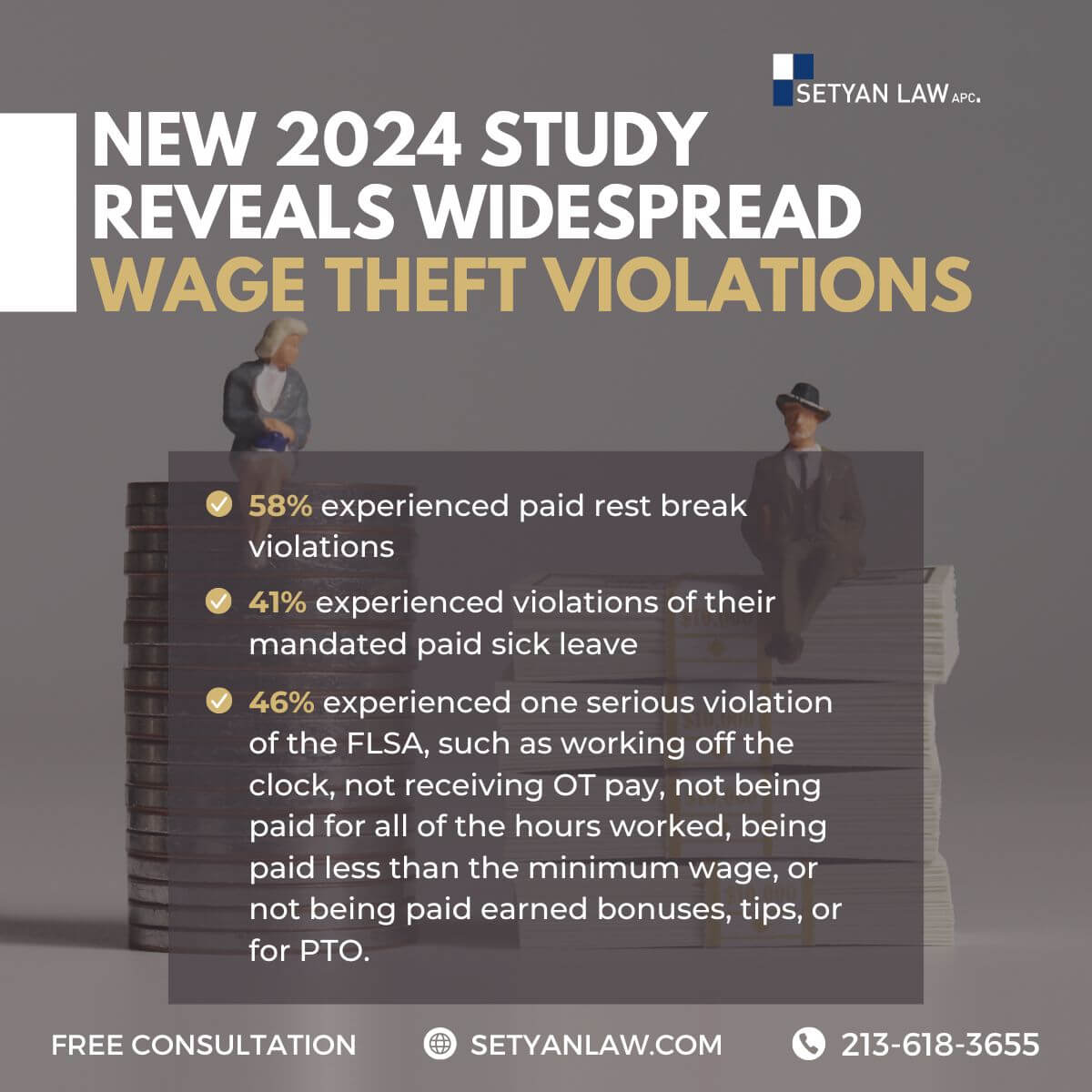

If you need employment litigation, call Setyan Law at (213)-618-3655. Free consultation.

Call Setyan Law at (213)-618-3655 to schedule a free consultation.