Updated July 1, 2025

Major Employment Law Changes Coming July 1, 2025

California new laws 2025 will bring sweeping changes to residents' daily lives when they take effect on July 1. From cracking down on stolen goods in online marketplaces to ensuring transparency in short-term rental fees, these new regulations aim to protect consumers and expand rights across the state. Additionally, schools will now be required to display suicide prevention resources, while workers in several cities will benefit from minimum wage increases. Furthermore, employees at large companies will gain access to fertility treatment coverage under expanded healthcare requirements. These significant legal changes reflect California's ongoing commitment to consumer protection, mental health support, worker rights, and healthcare access. Understanding these new laws is essential for all Californians as they navigate these important regulatory updates.

California Requires Online Marketplaces to Report Stolen Goods

Senate Bill 1144 takes aim at the rampant issue of stolen merchandise being sold through online platforms starting July 1, 2025. Introduced by former East Bay State Senator Nancy Skinner, now California Energy Commissioner, this legislation represents a significant step toward combating retail theft across the state.

What the new law mandates for platforms like eBay and Facebook Marketplace

Beginning July 1, all virtual marketplaces operating in California must establish clear policies prohibiting the sale of stolen goods on their platforms. These policies must be readily accessible to all users and explicitly state the marketplace's stance against trafficking stolen merchandise.

The legislation specifically targets major platforms such as eBay and Facebook Marketplace, requiring them to collect comprehensive information from high-volume third-party sellers. This data collection requirement aims to create accountability and traceability within these previously less-regulated online spaces.

According to the new regulations, marketplace platforms must implement:

- A publicly stated policy explicitly prohibiting stolen goods

- Information collection systems for high-volume sellers

- Mechanisms to identify potentially stolen merchandise

- Protocols for addressing suspected cases of stolen goods listings

This regulatory framework creates a standardized approach across all virtual marketplaces operating within California, thereby establishing consistency in how stolen goods are identified and handled.

How consumers can report suspected stolen items

Under SB 1144, online marketplaces must provide a straightforward process for consumers to report suspected stolen goods. This reporting mechanism must be easily accessible within the platform's interface, allowing any user to flag questionable listings.

The reporting process typically includes:

- A dedicated reporting button or form within the listing page

- Options to categorize the nature of the suspected violation

- Space for providing evidence or reasoning behind the suspicion

- Confirmation of report submission and expected follow-up timeline

Consequently, this consumer-driven reporting system creates an additional layer of monitoring beyond what the platforms themselves can provide. Since many stolen items have distinctive characteristics or markings known only to their rightful owners, this crowdsourced approach to identification significantly enhances detection capabilities.

Previously, consumers who spotted their stolen items for sale online faced challenges in getting platforms to respond appropriately. Nevertheless, this new legislation establishes a standardized channel for addressing these situations, empowering consumers to take direct action when they identify their stolen property being resold.

Penalties for non-compliance and law enforcement involvement

Perhaps the most robust aspect of SB 1144 is its requirement that online marketplaces alert law enforcement agencies when they know a third-party seller is attempting to sell stolen goods to California residents. This mandatory reporting creates a direct pipeline between digital marketplaces and police departments.

The law goes beyond mere internal policies by requiring active cooperation with authorities. Upon identifying suspicious activities or receiving credible reports of stolen merchandise, platforms must promptly share this information with relevant law enforcement agencies rather than simply removing the listings.

Although the legislation does not explicitly outline financial penalties for non-compliance, marketplaces face potential legal consequences for failing to implement the required policies and procedures. These might include:

- Civil penalties under California consumer protection laws

- Liability exposure in cases where stolen goods are sold through non-compliant platforms

- Potential restrictions on operating within California markets

- Reputational damage and loss of consumer trust

Subsequently, this enforcement mechanism creates genuine incentives for compliance beyond merely establishing policies on paper. Platforms must demonstrate actual implementation and cooperation with authorities to remain in good standing.

Through this comprehensive approach, California aims to disrupt the cycle of retail theft by eliminating easy online resale options for stolen merchandise. The legislation recognizes that tackling the market for stolen goods is equally important as addressing the theft itself in reducing overall retail crime rates across the state.

Short-Term Rentals Must Disclose All Cleaning Fees

The battle against hidden fees in vacation rentals intensifies with Assembly Bill 2202, which takes effect July 1 as part of California's new laws for 2025. This legislation specifically targets the often unexpected cleaning fees that have become a contentious issue for travelers using short-term rental platforms.

What AB 2202 changes for renters and hosts

AB 2202 establishes new transparency requirements for short-term lodging sites like Airbnb and similar platforms. Henceforth, these sites must clearly disclose any additional fees, charges, or penalties that might be added to a renter's bill if they fail to complete certain cleaning tasks before checkout. This represents a major shift from current practices where such fees may appear only after booking or during checkout.

The legislation mandates that rental platforms must:

- Disclose all potential cleaning-related charges upfront

- Provide detailed descriptions of required cleaning tasks before reservation

- Ensure fee information is presented in a clear, prominent manner

- Maintain consistency between advertised rates and final charges

Moreover, the law requires hosts to provide renters with a comprehensive description of all cleaning tasks expected of them prior to confirming a reservation. This advanced notification gives travelers full awareness of their responsibilities and potential additional costs before committing to a booking.

For hosts, this means revising their listings to explicitly outline cleaning expectations and associated fees. Notably, the legislation does not prohibit charging cleaning fees but instead focuses on transparency and disclosure, allowing consumers to make fully informed decisions when comparing rental options.

Fines for non-compliance and transparency requirements

The enforcement mechanism behind AB 2202 carries significant financial consequences for non-compliant platforms. Short-term lodging sites that fail to implement these transparency measures face fines of up to $10,000 per violation. This substantial penalty underscores the state's commitment to consumer protection in the vacation rental market.

The law establishes clear transparency requirements that must be met by all short-term rental platforms operating in California. In fact, these requirements extend beyond mere fee disclosure to include specifics about what constitutes adequate completion of cleaning tasks and what might trigger additional charges.

The implementation timeline gives platforms until July 1, 2025, to update their systems and policies. During this period, rental sites must develop or modify their interfaces to prominently display cleaning requirements and potential fees at the beginning of the booking process rather than revealing them later.

The legislation represents part of a broader effort to address consumer complaints about hidden fees in various industries. In the case of short-term rentals, cleaning fees have been particularly problematic because they often significantly increase the total cost of a stay beyond the advertised rate.

By mandating upfront disclosure, AB 2202 aims to create a more transparent marketplace where the true cost of a rental is immediately clear to consumers. This approach allows for fair comparison shopping and prevents the frustration of discovering unexpected charges late in the booking process or upon checkout.

Schools Must Display Suicide Hotline and QR Codes

A major step toward supporting student mental health emerges among California new laws 2025, as SB 1063 mandates schools display suicide prevention resources starting July 1. This legislation directly addresses growing concerns about youth mental health challenges by making crisis resources immediately accessible within educational environments.

Who is affected: Grades 7-12 in public and private schools

The new mandate applies broadly across California's educational landscape, requiring both public and private schools serving students in grades 7-12 to prominently display the 988 Suicide and Crisis Lifeline number. Indeed, the comprehensive scope ensures that adolescents across different educational settings have equal access to these critical resources.

The legislation creates uniform requirements that include:

- Printing the 988 Suicide and Crisis Lifeline number in visible locations throughout school facilities

- Including QR codes that link directly to local mental health resources and websites

- Making these resources accessible to all students in grades 7 through 12

- Implementing these displays by the July 1, 2025 deadline

Under these circumstances, every middle and high school campus in California must adapt their facilities to meet these requirements. The law makes no distinction between large urban districts and small rural schools—all must comply regardless of size or location.

Why mental health access is being prioritized

The implementation of SB 1063 reflects California's growing recognition of youth mental health as a public health priority. First thing to remember is that adolescence represents a particularly vulnerable period for mental health challenges, with suicide ranking among the leading causes of death for this age group.

By requiring schools to display the 988 Suicide and Crisis Lifeline, lawmakers acknowledge the vital role educational institutions play in connecting young people with essential resources. Important to realize, many students experiencing mental health crises may not know where to turn for help or might hesitate to ask adults directly.

The QR code requirement further enhances accessibility by:

- Providing immediate digital access to local resources

- Offering a discrete way for students to obtain help

- Connecting youth with age-appropriate mental health services

- Bridging the gap between crisis recognition and intervention

Certainly, this legislation represents part of a broader effort to destigmatize mental health discussions in educational settings. By making crisis resources visibly present in school environments, the law normalizes the concept of seeking help during difficult times.

The timing of this law alongside other mental health initiatives in California demonstrates a coordinated approach to addressing youth mental health challenges. In effect, schools now serve not only as places of academic learning but also as crucial access points for life-saving mental health resources.

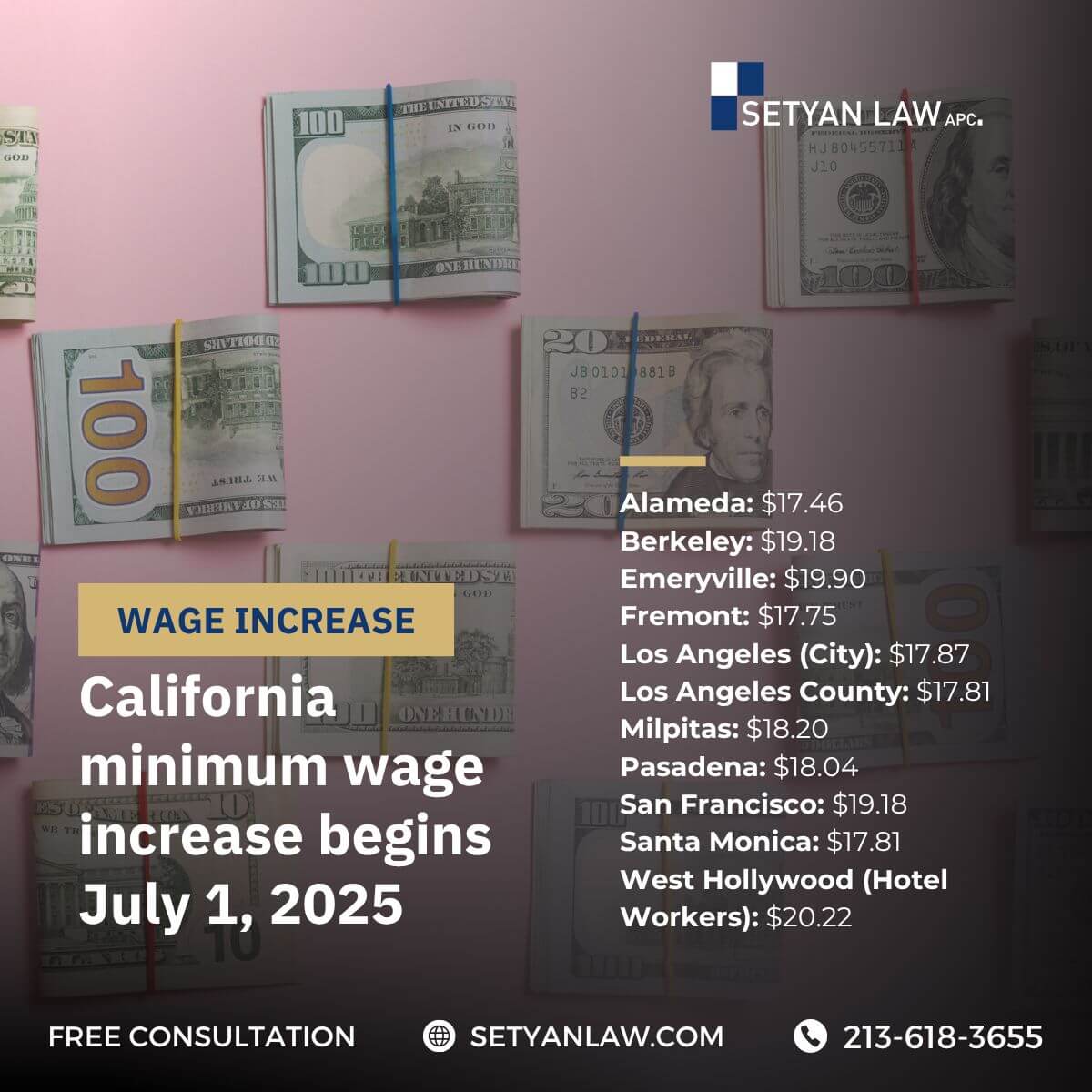

Minimum Wage Increases Take Effect in Multiple Cities

Alongside other California new laws 2025, workers across several Bay Area cities will see more money in their paychecks as minimum wage increases take effect on July 1. These wage adjustments represent part of planned annual increases that cities have implemented to address rising living costs.

List of cities and their new minimum wage rates

Six Bay Area cities have confirmed minimum wage increases starting July 1:

| City | New Minimum Wage |

|---|---|

| Emeryville | $19.90 |

| Berkeley | $19.18 |

| San Francisco | $19.18 |

| Milpitas | $18.20 |

| Fremont | $17.75 |

| Alameda | $17.46 |

Emeryville leads with the highest minimum wage at $19.90 per hour, positioning it as one of the highest municipal minimum wages in the country. Berkeley and San Francisco both match at $19.18 hourly, followed by Milpitas at $18.20. Fremont and Alameda round out the list with rates of $17.75 and $17.46 respectively.

Throughout these municipalities, the new rates reflect ongoing efforts to adjust wages to local economic conditions. The increases come as part of scheduled adjustments that many Bay Area cities have enacted in recent years.

How this impacts local businesses and workers

For workers in these cities, the wage increases translate to tangible financial benefits. A full-time employee working 40 hours weekly in Emeryville, for instance, will earn approximately $41,392 annually under the new rate—roughly $832 more per year than workers earning the same hours in Alameda.

As the wage gap between cities becomes more pronounced, businesses face varying labor cost structures depending on their location. Companies with operations across multiple Bay Area municipalities must now navigate different minimum wage requirements within relatively small geographic areas.

Small businesses, simultaneously confronting these wage increases and inflation, may need to adjust their pricing strategies or staffing models. Meanwhile, larger employers might absorb the increased labor costs more readily due to greater financial flexibility.

The timing of these increases coincides with broader economic adjustments throughout California, including the implementation of other employment-related legislation. As a result, the cumulative effect of these changes creates a shifting landscape for both employers and employees across the affected regions.

These minimum wage increases represent just one aspect of California's evolving labor regulations, with additional employment-related laws also taking effect in the same timeframe.

Employers Must Cover Fertility Treatments Under New Law

Reproductive healthcare access expands under California new laws 2025 with Senate Bill 729, which establishes new mandates for fertility treatment coverage. This legislation, authored by State Senator Caroline Menjivar, aims to make fertility treatments more accessible to workers across the state.

What SB 729 requires from large employers

The new law creates specific obligations for companies operating in California. Employers with at least 100 workers who provide health insurance benefits must now include coverage for:

- Infertility diagnosis procedures

- Various fertility treatment options

- In vitro fertilization (IVF)

This mandate represents a substantial shift in healthcare coverage requirements. By establishing these standards, SB 729 addresses gaps in reproductive healthcare access that previously left many Californians without affordable options for fertility assistance.

Senator Menjivar described the legislation as "a victory for reproductive justice in California" upon its signing by Governor Gavin Newsom last year.

Implementation timeline and possible delays

Originally scheduled to take effect on July 1, 2025, SB 729 now faces potential postponement. Recent developments suggest implementation might be delayed until January 2026.

The uncertainty stems from budget discussions. "It was proposed in the state budget trailer bill to delay the implementation, but our office has not received the final language," a spokesperson from Senator Menjivar's office told KTVU.

Throughout this transitional period, affected employers must prepare for compliance despite the uncertain timeline. The delay, if confirmed, would give businesses additional time to adjust their health insurance plans accordingly.

How CalPERS and other public employees are affected

Public sector employees face a different implementation schedule from private sector workers. For CalPERS members, which encompasses numerous state government employees, the fertility treatment coverage requirement has a separate effective date of July 1, 2027.

This two-year extension for public employees likely recognizes the complexity of modifying large-scale government benefit programs. As these changes progress, both public and private employers must develop implementation strategies that align with their specific compliance deadlines.

Conclusion

Looking Ahead: California's Evolving Regulatory Landscape

California's July 2025 legislative changes signify the state's continued commitment to addressing pressing social and economic concerns. These new laws tackle issues ranging from consumer protection to healthcare access, creating a framework that affects residents across diverse sectors.

Stolen merchandise trafficking faces stricter oversight as online marketplaces must now implement comprehensive reporting systems. This legislation aims to disrupt illegal reselling operations while empowering consumers through accessible reporting mechanisms. Similarly, vacation rentals become more transparent with mandatory disclosure of cleaning fees, allowing travelers to make fully informed decisions before booking accommodations.

Mental health support expands significantly as schools display suicide prevention resources, potentially saving young lives through increased accessibility to crisis services. Meanwhile, workers across several Bay Area cities gain financial benefits from minimum wage increases, though businesses must adapt to these elevated labor costs.

Fertility treatment access stands as another significant advancement, particularly for employees at larger companies. Despite possible implementation delays, this healthcare expansion reflects California's progressive stance on reproductive rights.

Taken together, these laws demonstrate California's multifaceted approach to protecting vulnerable populations while promoting economic fairness. The comprehensive nature of these changes showcases legislative priorities focused on everyday concerns rather than abstract principles.

Californians should familiarize themselves with these regulations before July 1 since they affect many aspects of daily life—from shopping online to planning vacations or seeking healthcare services. Understanding these changes allows residents to exercise their rights fully while navigating a regulatory environment designed to provide greater protections and opportunities for all.

If you need employment litigation, call Setyan Law at (213)-618-3655. Free consultation.