Updated March 22, 2025

Can an Employer Take Away Hours You’ve Already Worked?

In the complex landscape of employment rights, one of the most pressing concerns for workers is whether their employers can legally deduct hours that have already been worked. This issue often arises in various contexts, such as payroll discrepancies, timesheet alterations, or punitive measures taken by management. Understanding the legal framework surrounding these practices is essential for employees who wish to protect their rights and ensure they are fairly compensated for their labor.

In short: No, in general, an employer cannot retroactively take away hours you’ve already worked and refuse to pay you for them, as this constitutes wage theft and violates labor laws.

Understanding Employee Rights Under California Law

The Basics of Wage and Hour Laws

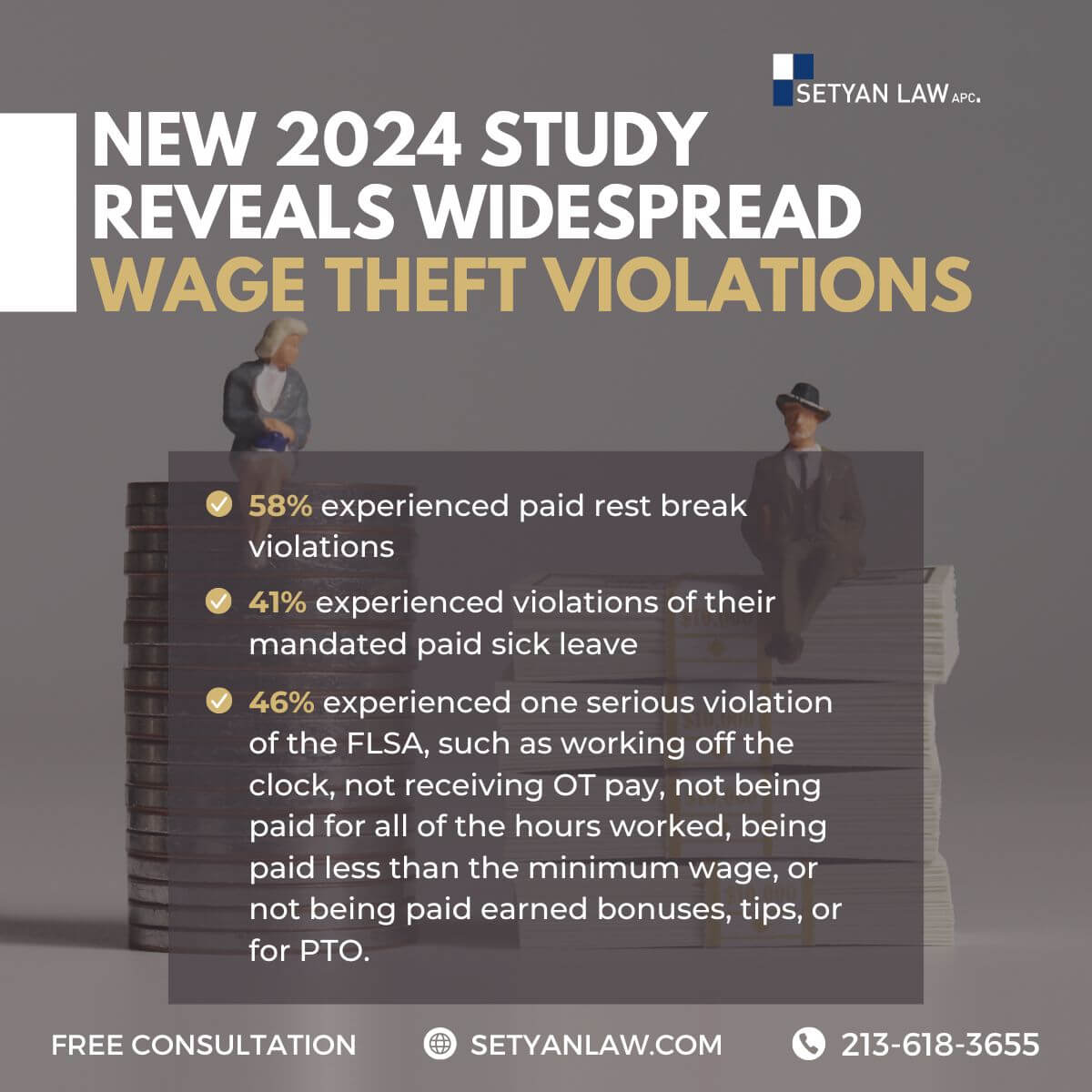

California law is designed to protect employees from unfair labor practices, including wage theft. Wage theft occurs when an employer fails to pay an employee for all hours worked, which can include not only straight time but also overtime. Under the California Labor Code, employees are entitled to receive their full wages for all hours worked, including any overtime that may be applicable.

The Fair Labor Standards Act (FLSA)

The Fair Labor Standards Act (FLSA) is a federal law that sets standards for minimum wage, overtime pay, and youth employment. In California, state laws often provide more robust protections than federal laws. However, understanding the FLSA is crucial, as it lays the groundwork for many labor rights across the country. Employers are prohibited from altering timesheets or manipulating hours worked to avoid paying employees what they are owed.

Employer Obligations

Employers in California have a legal obligation to accurately track and report the hours worked by their employees. This includes maintaining records of all hours worked, breaks taken, and any overtime accrued. Failure to keep accurate records can lead to significant legal ramifications for employers, including penalties and fines.

Can Employers Legally Deduct Hours Already Worked?

Legal Deductions vs. Illegal Practices

While employers are permitted to make certain deductions from paychecks, they cannot deduct hours that have already been worked without valid justification. For instance, if an employee works 40 hours in a week, the employer cannot simply choose to pay for 35 hours as a form of punishment or cost-cutting measure. Such actions constitute wage theft and are illegal under both California law and the FLSA.

Valid Reasons for Adjustments

There are legitimate scenarios where an employer may adjust an employee’s reported hours. These include:

- Correcting Errors: If a mistake is made in logging hours, employers have the right to correct these errors to reflect the actual time worked.

- Unpaid Breaks: Employers may deduct time for unpaid breaks, provided that these breaks are in compliance with state laws.

- Disciplinary Actions: While employers may not reduce hours as punishment, they can take disciplinary actions that may affect future hours or pay.

Potential Consequences for Employers

Employers who engage in illegal practices, such as altering timesheets to reduce hours worked, may face severe consequences. These can include:

- Legal Action: Employees have the right to sue for unpaid wages, and employers may be liable for damages.

- Fines and Penalties: The California Labor Commissioner’s Office can impose fines on employers who violate wage and hour laws.

- Reputational Damage: Companies found guilty of wage theft may suffer damage to their reputation, affecting employee morale and public perception.

Recognizing Signs of Wage Theft

Monitoring Your Hours

Employees should actively monitor their hours worked and compare them against their pay stubs. Keeping a personal record of hours can help identify discrepancies early on. Look for the following signs that may indicate wage theft:

- Inconsistent Paychecks: Regularly check if the pay received matches the hours worked.

- Missing Hours: If hours are consistently missing from paychecks, this may indicate an issue with how hours are reported.

- Changes in Timesheets: Be wary of any unexplained changes to timesheets after submission.

Steps to Take if You Suspect Wage Theft

If you believe your employer is manipulating your hours, consider the following steps:

- Document Everything: Keep records of your clock-in and clock-out times, as well as any communications regarding your hours.

- Speak to Your Supervisor: Address the issue directly with your supervisor or manager. Sometimes, discrepancies can arise from simple misunderstandings.

- Contact Human Resources: If the issue persists, escalate the matter to your company’s HR department. They are responsible for addressing employee concerns and ensuring compliance with labor laws.

- File a Complaint: If internal channels do not resolve the issue, you may consider filing a complaint with the California Division of Labor Standards Enforcement (DLSE).

Legal Recourse for Employees

Consulting an Employment Lawyer

If you find yourself in a situation where your employer is unlawfully altering your hours or failing to compensate you properly, consulting with an employment lawyer can be beneficial. An experienced attorney can help you understand your rights and guide you through the process of filing a complaint or pursuing legal action.

Filing a Claim with the DLSE

In California, employees have the right to file a wage claim with the DLSE if they believe their employer has violated wage and hour laws. This process includes:

- Filing a Claim: Complete the necessary forms and submit them to the DLSE.

- Investigation: The DLSE will investigate the claim, which may include interviews and document reviews.

- Resolution: If the claim is validated, the DLSE can order the employer to pay the owed wages.

Possible Outcomes of Legal Action

Legal action can yield various outcomes, including:

- Back Pay: Employees may receive compensation for unpaid wages.

- Penalties: Employers may face fines for violations of labor laws.

- Injunctions: Courts may issue orders to prevent employers from continuing illegal practices.

Protecting Your Rights as an Employee

Know Your Rights

Understanding your rights is the first step in protecting yourself from wage theft. Familiarize yourself with both federal and state labor laws that govern your employment. This knowledge empowers you to advocate for yourself effectively.

Keep Detailed Records

Maintaining accurate records of your hours worked, pay stubs, and any correspondence with your employer regarding hours is crucial. This documentation can serve as evidence if disputes arise.

Stay Informed About Changes in Labor Laws

Labor laws can change, so staying informed about current regulations is essential. Regularly check resources from the California Department of Industrial Relations for updates on labor laws and employee rights.

Conclusion

In conclusion, employers cannot legally take away hours that have already been worked. Engaging in such practices constitutes wage theft, which is prohibited under California law and the FLSA. Employees have rights, and it is crucial to understand these rights to protect oneself from unfair treatment in the workplace. If you suspect your employer is manipulating your hours, take proactive steps to document your situation and seek assistance. Remember, you are not alone, and legal resources are available to help you navigate these challenges effectively.

Conclusion

California’s "Ban the Box" law represents a significant step toward promoting fair employment practices and reducing discrimination against individuals with criminal records. By understanding the law’s provisions, both employers and job seekers can navigate the hiring process with greater confidence. This legislation not only opens doors for formerly incarcerated individuals but also enriches the workforce as a whole. As California continues to evolve its employment laws, staying informed is crucial for ensuring compliance and fostering a fair hiring environment. Contact a qualified California Wage and Hour Violation Lawyer with any questions you may have.