Updated January 27, 2026

Company Not Paying Promised Bonus? Your Legal Rights in California

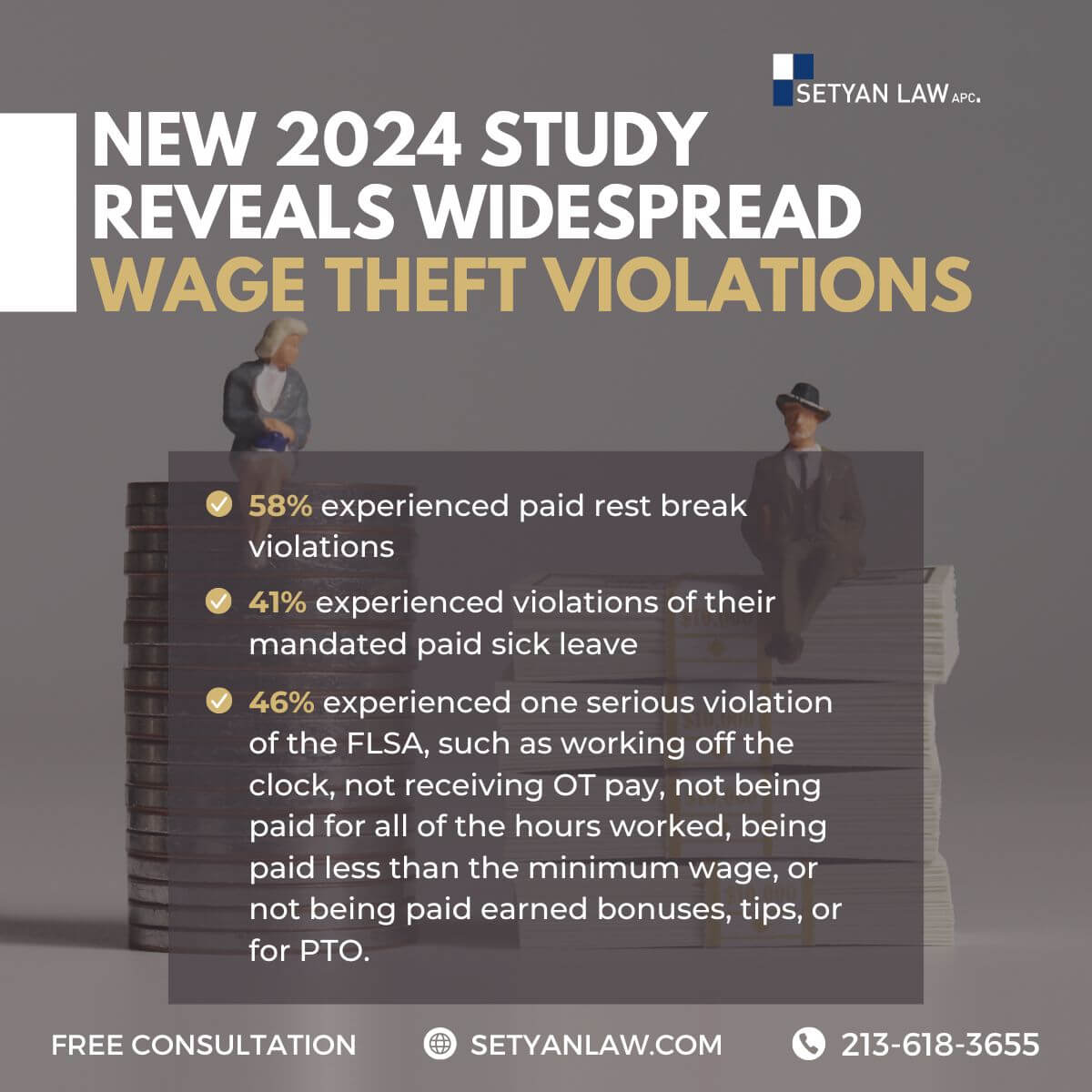

Has your company not paying promised bonus left you wondering about your legal options? Unfortunately, this frustrating situation affects thousands of California employees annually who count on these financial incentives for their hard work and dedication.

When an employer dangles the carrot of a bonus but fails to deliver, you're not simply out of luck. California labor laws provide significant protections for workers promised compensation. However, navigating these rights requires understanding crucial distinctions between discretionary and nondiscretionary bonuses, contract language, and specific state regulations that may entitle you to the money you've earned.

Importantly, your employment status, the specific wording in your bonus agreement, and even the timing of your bonus promise can dramatically impact your legal standing. In fact, many California employees successfully recover unpaid bonuses each year through proper legal channels.

This comprehensive guide examines your legal rights when facing a withheld bonus in California, outlines effective steps to take, and explains when and how to involve legal professionals to secure what you've rightfully earned.

Understanding Bonus Types in California

California labor law recognizes two distinct types of bonuses, each with different legal protections and implications for workers. Understanding these differences becomes crucial if your company isn't paying a promised bonus.

Discretionary bonuses: what they are

Discretionary bonuses function essentially as gifts from employers with no legal obligation attached. These "unearned" bonuses remain entirely at the employer's discretion regarding both timing and amount [1].

According to the Department of Labor, a bonus qualifies as discretionary only when:

- The employer maintains complete authority over both the decision to pay and the amount

- This decision remains solely with the employer until at or near the end of the relevant period

- No prior contract, agreement, or promise exists that would lead employees to expect such payments [2]

Common examples include holiday or year-end bonuses, employee-of-the-month recognitions, and rewards for handling particularly stressful situations [3]. These bonuses typically aren't tied to hours worked, production metrics, or efficiency standards [4].

Furthermore, discretionary bonuses don't factor into an employee's regular rate of pay calculations, making them separate from standard income for tax purposes [3].

Nondiscretionary bonuses: legally enforceable

Conversely, nondiscretionary bonuses are considered "earned" and protected as wages under California Labor Code Section 200 [1]. A bonus becomes non-discretionary if the employer has already promised it and can no longer change the amount or timing without breaching an agreement with the employee [4].

The primary characteristics that make a bonus non-discretionary include:

- Being tied to measurable performance metrics

- Resulting from a clear promise or agreement

- Creating a reasonable expectation among employees

- Following established formulas or standards [4]

Common examples include production bonuses tied to sales quotas, attendance incentives, quality/accuracy rewards, and safety achievement bonuses for accident-free periods [4]. Additionally, sign-on bonuses promised during recruitment immediately qualify as non-discretionary [4].

Notably, even without written documentation, consistent patterns of bonus payment can create implied contracts. Consequently, courts determine bonus classification based on actual circumstances rather than employer labels [4].

Why this distinction matters

The classification of your bonus has significant practical implications if your company withholds payment. Since non-discretionary bonuses are legally classified as wages under California labor law, they come with substantial legal protections [1].

First, non-discretionary bonuses must be included when calculating your regular rate of pay, directly affecting overtime calculations [3]. For non-exempt employees, this means your overtime rate increases when you earn such bonuses [5].

Additionally, California labor law provides two key protections for non-discretionary bonuses:

- They must be paid in a timely manner and appear on your pay statement

- They remain payable even after termination or resignation [1]

If you quit, you're entitled to receive earned bonuses within 72 hours of your last day (or on your final day if you provided 72+ hours notice) [1]. Similarly, if terminated, you should receive any earned bonuses immediately alongside other unpaid wages [1].

Most importantly, if your employer withholds a promised non-discretionary bonus after you've met the required conditions, this constitutes a wage violation. Unlike discretionary bonuses, which can be withheld for almost any reason, non-discretionary bonuses cannot be withheld due to issues like company cash flow problems [3]. In such cases, you have the right to file a wage claim with the California Labor Commissioner's Office [1].

When a Promised Bonus Becomes a Legal Right

Understanding exactly when your promised bonus transforms from a mere expectation into a legally enforceable right remains crucial for California employees facing nonpayment. The dividing line between what your employer can withhold versus what they must pay often comes down to specific details in your agreement.

What makes a bonus 'earned'

A bonus officially becomes "earned" once you fulfill all conditions established for receiving it. While discretionary bonuses remain largely at an employer's whim, non-discretionary bonuses create legal obligations as soon as specified criteria are met. These criteria typically include:

- Completing a predetermined number of work hours

- Achieving specific sales or production targets

- Meeting quality or efficiency standards

- Reaching company profit milestones

- Completing a retention period (for sign-on bonuses)

After meeting these requirements, your bonus immediately transforms into legally protected wages under California Labor Code Section 200. At this point, employers cannot legally withhold payment regardless of subsequent events. Even your employment termination—whether voluntary or involuntary—does not negate the employer's obligation to pay bonuses legitimately earned before your departure.

Moreover, California courts consistently look beyond employer terminology to examine the actual substance of bonus arrangements. Therefore, merely labeling a performance-based incentive as "discretionary" does not exempt employers from payment obligations once criteria are satisfied.

How contracts and policies define bonus terms

Bonus terms may be established through several different channels, each carrying legal weight. Employment contracts frequently outline bonus structures alongside base compensation. Alternatively, many companies issue separate "bonus agreements" detailing specific terms. These agreements hold particular significance because they explicitly define what constitutes an earned bonus.

Beyond formal documents, bonus terms sometimes appear in employee handbooks, verbal promises during hiring negotiations, or consistent company practices. Importantly, California recognizes implied contracts created through repeated patterns of bonus payment. Even without written documentation, courts may enforce bonus obligations based on established company precedent.

Generally, the more specific the terms regarding performance metrics, calculation methods, and payout timing, the stronger your legal position becomes if disputes arise. While verbal agreements pose greater evidentiary challenges, they remain potentially enforceable—especially with supporting documentation like emails referencing the arrangement.

Common employer tactics to avoid payment

Unfortunately, many California companies employ various strategies to evade bonus payment obligations. One widespread tactic involves terminating employees shortly before bonus payout dates. Although this practice seems underhanded, companies often include "active employment" clauses requiring continued employment on the specific payout date.

Another common strategy involves retroactively altering bonus criteria after employees have already invested substantial effort toward meeting original targets. Without careful documentation of initial terms, these modifications can prove difficult to challenge.

Misclassification represents yet another prevalent tactic. Many employers incorrectly label non-discretionary bonuses as "discretionary" specifically to avoid including them in overtime calculations or to retain greater flexibility in withholding payment.

Likewise, some companies implement prohibitively strict eligibility requirements or establish deliberately ambiguous performance metrics that allow selective interpretation. Others institute unreasonably short claim periods for bonus disputes, hoping employees will miss deadlines.

Beginning January 1, 2026, California will implement Assembly Bill 692, significantly restricting certain "stay-or-pay" practices related to sign-on and retention bonuses. This legislation will limit employers' ability to impose repayment obligations for upfront bonuses if employment ends prematurely. Sign-on bonuses will require separate agreements, attorney consultation periods, and prorated repayment structures—while retention bonuses for existing employees cannot include repayment obligations at all.

What Happens If You Quit or Get Fired

Terminating your employment relationship creates immediate questions about your bonus eligibility. Fortunately, California offers substantial protections for earned compensation, even after you leave your job.

Can you still claim your bonus?

First of all, California law explicitly entitles you to all wages earned at the end of your employment—including certain bonuses [6]. The key distinction lies in whether you've already qualified for the bonus before departing.

If you met all conditions necessary to receive the bonus before leaving, California treats that bonus as earned wages that must be paid [7]. Even after resignation or termination, employers are required to pay these earned bonuses within 72 hours of your final day [8].

The situation differs slightly based on how you left:

- If you quit: You're entitled to all earned bonuses, though discretionary bonuses typically remain unpayable [9]

- If terminated: You're entitled to earned bonuses on your final day, regardless of the reason for termination [8]

Naturally, determining what constitutes "earned" becomes crucial. If your bonus plan includes prorated language, this usually strengthens your claim to partial payment even after departure [6].

Impact of 'active employment' clauses

Many bonus plans include provisions requiring you to be "actively employed" on the payout date. These clauses significantly influence your eligibility.

In the landmark case Neisendorf v. Levi Strauss & Co., California courts established that employers can legally create bonus plans conditioning payment on continued employment through the payout date [7]. The court determined that such requirements, when clearly stated in advance, do not constitute illegal forfeiture of earned compensation [7].

Usually, when explicit active employment requirements exist, employees terminated before the payout date may legally be denied their bonuses—even for bonuses tied to work already performed [7]. The rationale: you haven't fulfilled all conditions of the bonus plan.

Nevertheless, these clauses aren't absolute shields for employers. Courts evaluate whether the employer acted in good faith when enforcing such provisions [3].

Wrongful termination to avoid bonus payout

Certain employers deliberately accelerate termination timing to avoid bonus payments. This practice, typically when involving substantial sums, can constitute wrongful termination [3].

California courts consistently rule that firing an employee specifically to avoid paying earned compensation violates public policy and breaches the implied covenant of good faith [3][10]. Of course, proving this motivation requires substantial evidence.

Factors strengthening wrongful termination claims include:

- High performer status before sudden termination

- Termination timing immediately before bonus payout

- Lack of proper disciplinary procedures

- Petty or inconsistent reasons given for dismissal [3]

Even employers citing "at-will" employment status cannot legally terminate workers solely to avoid paying earned wages [3]. Fundamentally, California law prioritizes protecting employees from manipulation of bonus payment structures through bad-faith termination.

Commission-Based Bonuses and California Law

Sales professionals often face unique challenges when pursuing unpaid compensation. In fact, commission disputes represent one of the most common wage-related complaints filed with California labor authorities.

How commissions differ from regular bonuses

Commissions fundamentally differ from standard bonuses in both structure and legal standing. Initially, commissions must be directly tied to sales activities, specifically calculated as a percentage of the amount or value of goods or services sold. In contrast, even performance-based bonuses typically involve fixed sums rather than percentage-based calculations [11].

Furthermore, while regular bonuses might be tied to various performance metrics, commissions exclusively reward successful sales transactions. This distinction matters substantially as California labor law provides specific protections for commission-based compensation that may not apply to other incentive structures [12].

Legal classification of commissions as wages

California law explicitly classifies earned commissions as wages under Labor Code Section 200 [11]. Consequently, employers must follow strict requirements regarding both documentation and payment timing.

Since 2013, California Labor Code Section 2751 has required employers to provide written commission agreements to all employees whose compensation involves commissions [13]. These agreements must detail:

- The method for calculating commissions

- How and when commissions will be paid

- Conditions for earning commissions

- Any deductions or adjustments that may apply [11]

Most importantly, once earned according to the terms of your agreement, commissions become legally protected wages that cannot be forfeited [11]. Accordingly, employers must pay these earned commissions at least twice monthly, following California's regular payday laws [11].

Common misclassifications by employers

Employers routinely attempt to evade commission payment obligations through various misclassifications. One widespread tactic involves incorrectly labeling true commissions as discretionary bonuses to retain greater payment flexibility [12].

Even more concerning, many employers implement invalid "forfeiture provisions" claiming employees must remain employed on specific payout dates to receive previously earned commissions [1]. Despite these provisions, California courts frequently rule that termination does not invalidate an employee's right to receive commissions for sales they've already completed [1].

Additionally, some employers incorrectly apply the "outside salesperson" exemption to inside sales staff, attempting to avoid overtime obligations. For this exemption to apply legitimately, an employee must spend more than half their working time away from the employer's place of business selling products or services [14].

Steps to Take If Your Bonus Is Withheld

When faced with a withheld promised bonus, taking methodical steps can help protect your rights under California labor laws. Pursuing unpaid bonuses requires understanding specific procedures and timelines to maximize your chances of recovery.

Review your employment agreement

First, thoroughly examine all documents related to your bonus structure. Look for specific language defining when a bonus becomes "earned" and any conditions affecting payment eligibility. Pay particular attention to employment contracts, bonus agreements, and company policies that outline calculation methods and payout schedules. Even verbal promises or consistent payment patterns can create implied contracts in California.

Gather documentation and evidence

Next, collect comprehensive evidence supporting your claim. This includes pay stubs, performance reviews, emails discussing the bonus, and any written communications regarding your eligibility. Document all verbal discussions about your bonus, noting dates, participants, and content. For commission-based bonuses, compile sales records demonstrating you met required targets. Keep meticulous records of all attempts to resolve the issue internally.

File a wage claim with the Labor Commissioner

Should informal resolution attempts fail, you can file a wage claim with California's Labor Commissioner's Office. Claims must be filed within specific timeframes: two years for oral agreements, three years for unpaid wages including bonuses, and four years for written contracts [15]. After submitting your claim, you'll receive notification of next steps, typically beginning with a settlement conference [16]. If unresolved there, a formal hearing follows where evidence is reviewed by a hearing officer [16].

When to involve an employment attorney

Consider legal representation immediately for complex cases involving substantial sums or when facing retaliatory actions. An attorney becomes especially valuable when dealing with ambiguous bonus terms, active employment clauses, or situations where termination might have been motivated by bonus avoidance. Employment lawyers can also help determine if your case warrants civil litigation beyond administrative remedies [9]. For effective representation, provide your attorney with all relevant documentation, particularly evidence showing the bonus was tied to measurable performance outcomes you achieved [17].

Conclusion

Understanding your legal rights regarding unpaid bonuses stands as a critical first step toward recovering what you've rightfully earned. California labor laws offer robust protections, especially for non-discretionary bonuses that qualify as wages under state regulations. Therefore, knowing whether your bonus falls into the discretionary or non-discretionary category significantly impacts your legal standing.

Documentation proves essential throughout this process. Emails, contracts, company policies, and performance metrics all serve as valuable evidence should you need to pursue legal action. Additionally, timing matters greatly—both in terms of when you fulfilled bonus requirements and how quickly you file any necessary claims.

Employment status changes complicate bonus situations but do not necessarily eliminate your rights. Though "active employment" clauses may affect eligibility, employers cannot terminate you simply to avoid bonus payments. Similarly, commission-based compensation carries specific legal protections that many employers attempt to circumvent through misclassification.

The path forward depends largely on your specific circumstances. Many employees successfully recover unpaid bonuses through direct communication with employers or by filing wage claims with California's Labor Commissioner. Nevertheless, cases involving substantial sums, ambiguous terms, or potential wrongful termination often benefit from professional legal guidance.

Remember that California law ultimately sides with workers who have genuinely earned their compensation. While employers may use various tactics to withhold promised bonuses, these practices face increasing scrutiny under evolving state regulations. Armed with proper documentation and knowledge of your rights, you can effectively challenge unfair bonus withholding and secure the financial rewards promised for your hard work.

Call Setyan Law at (213)-618-3655 to schedule a free consultation.