Updated January 26, 2026

What Is the Penalty for an Employer Clocking Me Out?

If you’ve ever checked your time records and discovered your employer “clocked you out” early—or clocked you out while you were still working—you’re not alone. This practice can happen in subtle ways, such as a manager editing a timesheet, changing a punch-out time, or automatically deducting time for breaks you didn’t take. Other times, it’s blatant: you’re told to keep working after you’re clocked out.

No matter how it happens, the key issue is the same: if you are working, you must be paid. When an employer clocks you out while you are still performing job duties, it can amount to wage theft and may violate federal and state labor laws. The “penalty” for this conduct depends heavily on your location, the employer’s intent, and how much unpaid time is involved—but employees often have powerful legal remedies.

Below is a practical, plain-English breakdown of what this conduct means, what laws may apply, and what penalties an employer may face.

What Does It Mean When an Employer “Clocks Me Out”?

An employer “clocking you out” generally refers to any situation where your employer:

- Changes your time punches to reduce your paid hours

- Removes overtime hours from your timecard

- Automatically clocks you out at a scheduled time even if you’re still working

- Deducts meal breaks you did not take

- Requires you to work “off the clock” after you’ve been clocked out

In many workplaces, employees don’t realize it’s happening until they compare their own records to their pay stub—or notice their

paycheck seems short week after week.

Even small edits can add up. For example, if your employer shaves just 10–15 minutes per day, that can mean hours of unpaid work over

the course of a month.

Is It Illegal for an Employer to Clock Me Out?

It can be illegal, especially when the clock-out results in unpaid work time.

Under wage and hour laws, employers generally must:

- Pay employees for all “hours worked”

- Maintain accurate time records

- Pay overtime when required

- Provide meal/rest breaks where state law requires them

If your employer clocks you out but still expects you to work, that is typically unlawful. The law does not allow employers to avoid paying wages simply by manipulating timekeeping records.

“But I Agreed to It” — Does That Matter?

Sometimes employees feel pressured to “go along” with off-the-clock work or time edits. Even if you didn’t complain at the time, you may still have a valid claim.

Wage laws generally focus on what actually happened—whether you worked and whether you were paid—not whether the employer got you to “accept” it.

Common Examples of Illegal Clock-Out Practices

Here are some of the most common scenarios that may lead to penalties:

1. Being clocked out at closing time but told to finish tasks

Example: You’re scheduled until 10:00 p.m., but the manager clocks you out at 10:00 and tells you to finish cleaning, closing registers, or restocking.

2. Automatic meal break deductions

Example: Your time system automatically deducts 30 minutes for lunch, but you skipped lunch or worked through it.

3. Edited time punches without your approval

Example: You clock out at 6:15 p.m., but payroll changes it to 6:00 p.m. to reduce overtime.

4. Pre-shift or post-shift work

Example: You’re expected to set up equipment, boot up systems, attend a meeting, or complete paperwork before clocking in or after clocking out.

5. “Rounding” that consistently benefits the employer

Some rounding practices are legal in limited circumstances, but if rounding always reduces employee pay, it may violate wage laws.

What Laws Protect Employees From Being Clocked Out Unfairly?

Federal Law: The Fair Labor Standards Act (FLSA)

The FLSA is the main federal wage and hour law. It generally requires covered employers to:

- Pay at least minimum wage

- Pay overtime (usually time-and-a-half) for hours over 40 in a workweek for non-exempt employees

- Keep accurate records of hours worked

Under the FLSA, work performed must be paid, even if the employer did not “authorize” it—so long as the employer knew or should have known the work was happening.

That’s important because many employers try to defend themselves by saying, “We didn’t approve overtime,” or “They were told not to work off the clock.” But if the employer benefits from the work and allows it to happen, the employer may still be responsible for paying.

State Laws May Provide Stronger Protections

Many states provide additional rights, including:

- Daily overtime (in some states)

- Required meal and rest breaks

- Wage statement penalties

- Faster payment deadlines

- Statutory penalties for late or missing wages

In some states, penalties can exceed the unpaid wages themselves.

California Law: Penalties for an Employer Clocking You Out While You’re Still Working

In California, employers must pay employees for all hours worked and maintain accurate time records. If an employer clocks you out early, edits your timecard, or requires you to work “off the clock,” it can violate multiple California wage-and-hour laws and expose the employer to significant financial penalties.

Unpaid Wages and Overtime

The employer may be required to pay back wages for all unpaid time, including any missed overtime. California overtime rules can be more protective than federal law, including overtime for working more than 8 hours in a day (and in some cases double time for longer shifts), in addition to weekly overtime.

Meal and Rest Break Violations

If the employer clocks you out for a meal break you didn’t actually receive, or automatically deducts meal periods when you worked through them, the employer may owe meal period premiums (typically one additional hour of pay at your regular rate for each day a compliant meal period was not provided). Similar premium pay can apply for missed rest breaks.

Wage Statement and Recordkeeping Penalties

When an employer alters time records, it often leads to inaccurate pay stubs. California law requires employers to provide accurate wage statements, and employers can face additional penalties for failing to do so—especially when the errors cause employees to be underpaid.

Waiting Time Penalties (If You Quit or Are Fired)

If an employee separates from employment and the employer fails to pay all wages owed on time—including unpaid off-the-clock work—then the employer may owe waiting time penalties, which can be up to 30 days of additional wages depending on the circumstances.

Additional Exposure for Pattern-and-Practice Violations

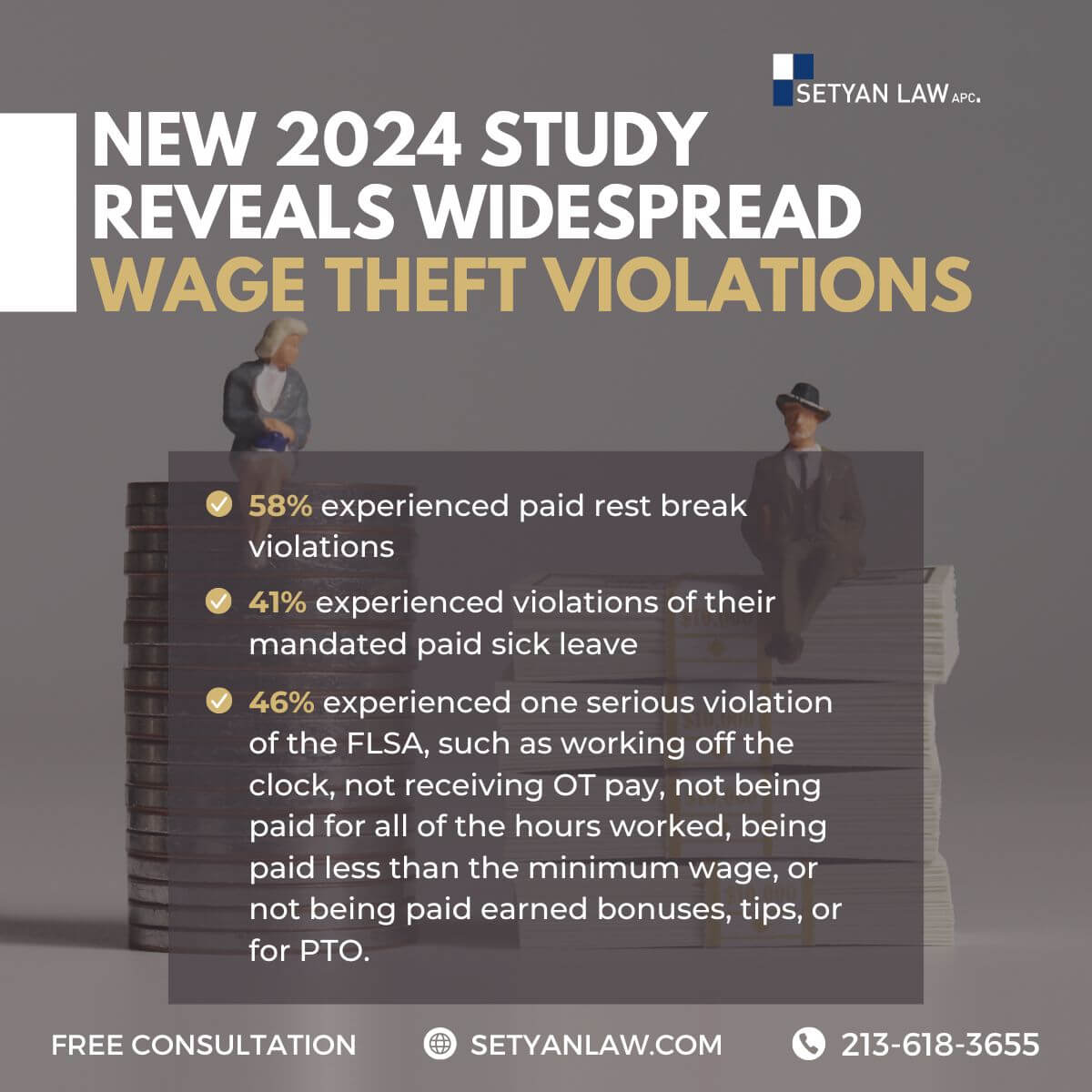

If clocking employees out early is a regular policy or widespread practice affecting multiple workers, the employer may face broader exposure through a class action, a PAGA claim, or enforcement actions that increase the overall financial risk beyond just the unpaid wages.

Bottom line: In California, an employer clocking you out while you’re still working can trigger liability for unpaid wages, overtime, meal/rest break premiums, wage statement penalties, and potentially waiting time penalties—making the total “penalty” far more expensive than simply paying the missing minutes.

So What Is the “Penalty” for an Employer Clocking Me Out?

The penalty can take several forms. In most wage cases, the employer may be required to pay:

- Back pay (unpaid wages)

- Unpaid overtime

- Interest

- Additional “liquidated damages” or statutory penalties

- Attorneys’ fees and costs

- Civil penalties assessed by a labor agency

- Potential criminal penalties in extreme cases (rare, but possible)

Let’s break these down.

1) Back Pay: The Employer Must Pay What You’re Owed

The most basic penalty is straightforward: your employer must pay you the wages you earned but didn’t receive.

This includes:

- Unpaid hourly wages

- Unpaid overtime premiums

- Unpaid minimum wage shortfalls

Back pay is calculated by reconstructing what you should have been paid if your time had been recorded correctly.

Even if the employer’s time records are incomplete or altered, employees can often prove hours worked through:

- Personal notes or calendars

- Text messages and emails

- Work schedules

- Security badge logs

- Delivery records

- Witness statements from coworkers

- Phone location data or app logs

Courts often allow employees to estimate hours when the employer failed to keep accurate records.

2) Overtime Pay: Time-and-a-Half (or More) Adds Up Quickly

If the clock-out manipulation caused you to lose overtime pay, that can significantly increase the employer’s liability.

For example, if you worked 45 hours in a week but the employer edited your timecard to show 40, you could be owed:

- 5 hours of overtime pay at 1.5x your regular rate

- Plus potential penalties and damages

Overtime violations are among the most common wage claims tied to time-shaving.

3) Interest: Some States Add Interest Automatically

Many jurisdictions require employers to pay interest on unpaid wages, particularly if wages were withheld for an extended period.

Even if the unpaid amounts seem small at first, interest can increase the total recovery—especially over months or years.

4) Liquidated Damages: Often Equal to the Unpaid Wages

Under federal law, employees may be entitled to liquidated damages, which are often equal to the amount of unpaid wages.

That means in many cases, the employer may owe double damages:

- $2,000 unpaid wages

- + $2,000 liquidated damages

- = $4,000 total (before fees and interest)

Employers can sometimes avoid liquidated damages if they prove they acted in good faith and reasonably believed they complied with the law—but that defense is not always easy to establish, especially when time records were altered.

5) Attorneys’ Fees and Costs: The Employer May Have to Pay Your Lawyer

One major reason wage claims can carry real financial risk for employers is that many wage laws allow employees to recover:

- Attorneys’ fees

- Litigation costs

This matters because legal fees can exceed the unpaid wages in some cases, especially when the employer fights the claim aggressively or the case becomes a class or collective action.

6) Civil Penalties and Agency Enforcement

In addition to private lawsuits, employees can often file wage complaints with a state labor agency.

If an agency investigates and finds violations, the employer may face:

- Civil fines

- Penalties per pay period or per employee

- Orders to correct timekeeping practices

- Audits of payroll records

In some industries, repeat wage violations can trigger larger enforcement actions.

7) Wage Statement and Recordkeeping Penalties

Clocking an employee out improperly often goes hand-in-hand with inaccurate pay stubs and time records.

Some jurisdictions penalize employers for:

- Failing to provide accurate wage statements

- Omitting required information

- Keeping inaccurate time records

- Not preserving records for required periods

These penalties can add up on a per-paycheck basis, especially for ongoing violations.

What If the Employer Says I Wasn’t “Working”?

A common defense is that the employee was not actually performing compensable work. Employers may claim the time was “voluntary,”

“de minimis,” or not necessary.

But work time can include more than obvious labor.

Work that may be compensable includes:

- Logging into computers or systems

- Waiting for tasks while under employer control

- Attending mandatory meetings

- Putting on required protective gear

- Closing procedures

- Cleaning and restocking

- Responding to work calls or messages

- Travel time in certain job-related contexts

If your employer required or allowed these activities, they may be considered work time.

Does It Matter If the Employer Did It On Purpose?

Yes. Intent can affect the penalty.

If the employer’s conduct appears willful—such as knowingly editing time records, instructing employees to work off the clock, or repeatedly shaving time—then:

- The employer may face increased damages

- The “lookback” period for unpaid wages may be longer in some jurisdictions

- The employer may be exposed to broader claims (including group claims)

Even if the employer claims it was a mistake, repeated patterns often tell a different story.

Can This Become a Class Action or Group Claim?

It can.

If multiple employees are experiencing the same practice—such as automatic clock-outs, meal break deductions, or a manager editing timecards—then the claim may expand into:

- A class action (in some state law contexts)

- A collective action (under federal overtime law)

- A multi-employee wage claim with a labor agency

Employers face far greater liability when the problem is systemic.

What Should You Do If Your Employer Is Clocking You Out?

If you suspect your employer is clocking you out early or changing your time, you should act carefully and strategically.

1. Keep your own records

Track:

- Your actual start and end times

- Meal breaks taken (or not taken)

- Any after-hours work

- Messages instructing you to work off the clock

2. Save proof of work activity

Examples include:

- Text messages from managers

- Emails

- Photos of posted schedules

- Screenshots of time punches

- Work app login logs

3. Compare pay stubs to your recollection

Look for:

- Missing overtime

- Shortened shifts

- Automatic lunch deductions

- Inconsistent hours week to week

4. Be cautious about confronting management

Some employees choose to raise the issue internally. Others prefer to consult a wage-and-hour attorney first. If you fear retaliation, it may be safer to get legal advice before escalating.

5. Consider speaking with a wage and hour lawyer

Many attorneys can quickly evaluate:

- Whether the time edits violate the law

- What damages you may be entitled to

- Whether others at work have the same issue

- What deadlines apply

Can You Be Fired for Complaining?

Retaliation is a serious concern.

In many jurisdictions, it is unlawful for an employer to retaliate against an employee for:

- Requesting unpaid wages

- Reporting wage violations

- Filing a wage claim

- Participating in an investigation

- Speaking with an attorney

Retaliation can include:

- Termination

- Reduced hours

- Demotion

- Harassment

- Schedule changes meant to punish

If retaliation occurs, it may create additional claims and damages beyond the unpaid wages.

How Long Do You Have to File a Claim?

Deadlines (called “statutes of limitations”) vary depending on:

- The state you work in

- Whether the claim is under federal or state law

- Whether the employer’s conduct was willful

- The type of wage violation

Because wage claims can be time-sensitive, it’s best to act sooner rather than later.

Bottom Line: Employers Can Face Serious Consequences for Clocking You Out

If your employer clocks you out while you are still working, the penalty is not just “paying you later.” In many cases, employers may be responsible for:

- Paying back wages and overtime

- Paying additional damages (sometimes doubling what you’re owed)

- Paying interest

- Paying attorneys’ fees and costs

- Paying civil penalties for recordkeeping and wage statement violations

- Facing investigations, audits, or broader group claims

Most importantly, employees should understand this: your employer cannot legally require you to work for free. If you worked, you are generally entitled to be paid—and if your employer manipulated time records to avoid paying you, that may be a serious labor law violation.

If you believe this is happening to you, documenting your hours and seeking legal guidance can be the difference between continuing to lose wages and recovering what you’re owed.

If you’d like, I can also write a state-specific version (for example, California, New York, Florida, Texas, etc.) that explains the exact penalties and deadlines where you work.

Call Setyan Law at (213)-618-3655 to schedule a free consultation.