Updated October 13, 2025

California’s Freelance Worker Protection Act (FWPA)

The Freelance Worker Protection Act (FWPA) is a California law signed on September 30, 2024, that establishes minimum requirements for contracts between hiring parties and freelance workers, providing various protections for independent contractors . The act takes effect on January 1, 2025, and applies to contracts entered into or renewed on or after that date .

Under the FWPA, a "freelance worker" is defined as a person or organization composed of no more than one person who is hired or retained as a bona fide independent contractor by a hiring party to provide professional services in exchange for an amount equal to or greater than $250.00 . This threshold applies either to a single contract or when aggregating all contracts between the same hiring party and independent contractor during the immediately preceding 120 days .

"Professional services" refers specifically to services outlined in California Labor Code Section 2778, which includes:

- Marketing

- Human resources administration

- Travel agent services

- Graphic design

- Grant writing

- Fine artist work

- Photography, videography, and photo editing

- Writing, translating, editing, and illustrating

- Specialized performance instruction

- Licensed esthetician, electrologist, manicurist, barber, and cosmetologist services

The FWPA defines a "hiring party" as a person or organization in California that retains a freelance worker to provide professional services . Notably, the act excludes several entities from this definition, including the U.S. government, the State of California, foreign governments, and individuals hiring services for personal benefit, family members, or homestead .

At its core, the FWPA mandates written contracts that must include specific information: names and addresses of both parties, itemized services with values and compensation methods, payment due dates or determination mechanisms, and deadlines for freelancers to submit service lists to facilitate timely payment .

Additionally, the act requires hiring parties to pay freelancers by the contract-specified due date or within 30 days of service completion if no date is provided . Furthermore, the FWPA prohibits discrimination or adverse actions against freelance workers who oppose practices prohibited by the act, participate in related enforcement proceedings, or assert their rights under the law .

The law also forbids hiring parties from requiring freelancers to accept less compensation or provide additional services beyond the contract terms as conditions for timely payment once work has commenced .

Who is covered under the FWPA?

The Freelance Worker Protection Act covers natural persons hired or retained as independent contractors who provide products or services in Illinois or for a contracting entity located in Illinois . Qualifying freelance workers must earn compensation equal to or greater than $500.00, either through a single contract or when aggregated across all contracts with the same contracting entity during the immediately preceding 120-day period .

Freelance workers operate across numerous industries, particularly in creative fields. Common sectors include film, video, photography, graphic and web design, social media management, content creation, media and journalism, translation services, and personal care such as hair styling and makeup artistry .

However, several categories of workers are explicitly excluded from FWPA protections. These exceptions include:

- Construction workers

- Individuals performing services as employees under Section 10 of the Employee Classification Act

- Employees as defined under Section 2 of the Illinois Wage Payment and Collection Act

- Individuals contracted by the US government, State of Illinois, units of local government (including school districts), or any foreign government

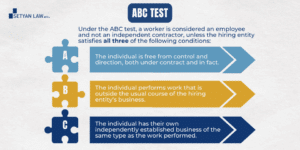

Consequently, determining whether an individual qualifies as a freelance worker requires careful assessment of both their employment classification and compensation levels.

The definition of "contracting entity" under the FWPA encompasses "any person who retains a freelance worker to provide any service" . In this context, "person" refers to any natural person, individual, corporation, business enterprise, or other legal entity, whether public or private, alongside their successors, agents, or representatives .

It is worth noting that the FWPA applies specifically to agreements that take effect on or after July 1, 2024 . Moreover, this legislation differs from similar laws in other states. For instance, California's version defines freelance workers differently, with a lower monetary threshold of $250.00 and specific professional services requirements .

Understanding these coverage parameters is essential for both freelance workers seeking protection and contracting entities striving for compliance. The FWPA represents an important expansion of legal safeguards for independent contractors in Illinois, establishing clear criteria for who qualifies for these protections.

What must be included in a freelance contract?

Written contracts stand as a fundamental requirement under the Freelance Worker Protection Act for any freelance engagement valued at $250.00 or more . These contracts must contain several mandatory elements to be considered legally compliant . The FWPA mandates that hiring parties provide a signed copy of the contract to freelance workers (either physically or electronically) and retain it for at least four years .

Name and address of both parties

Every freelance contract must clearly state the legal names and mailing addresses of both the hiring party and the freelance worker . This identification requirement ensures all parties can be properly contacted throughout the duration of the agreement . For businesses operating under different legal names than their own, the contract should include the legal company name rather than just the individual's name .

Itemized list of services and payment terms

Contracts must contain a detailed itemization of all services the freelance worker will provide . This itemization should include the specific value of those services along with the rate and method of compensation . Clearly defining the scope prevents misunderstandings and potential scope creep where clients request additional work without appropriate compensation . The contract should outline whether payment will be structured as a fixed project fee, hourly/daily rates, or milestone-based payments .

Payment due date or method to determine it

The FWPA requires contracts to specify either the exact date when the hiring party will pay the contracted compensation or the mechanism by which this date will be determined . Without a specified payment date, compensation becomes due 30 days after work completion . Some contracts may include late fee provisions, typically ranging from 1-5% interest for each day, week, or month that payment is delayed .

Deadline for submitting completed services

Contracts must establish a clear deadline by which the freelance worker must submit a list of services rendered to meet the hiring party's internal processing deadlines for timely payment . This element ensures both parties understand when deliverables are expected and prevents delays in the payment process . Additionally, establishing deadlines for client responses helps set expectations and prevents delays caused by late feedback or unresponsiveness .

How does the FWPA regulate payment?

Payment regulations form a central component of the Freelance Worker Protection Act, establishing clear timelines and protections concerning compensation. In accordance with the FWPA, hiring parties must pay freelance workers on or before the date specified in their contract . Where no payment date is explicitly stated, payment must occur no later than 30 days after the freelance worker completes the contracted services .

The act creates substantial protections against payment manipulation once work has begun. Primarily, after a freelance worker has commenced providing services, the hiring party is prohibited from requiring them to accept less compensation than originally agreed upon as a condition for timely payment . Similarly, the hiring entity cannot demand additional services or goods beyond what was specified in the contract in order to receive prompt payment .

Concerning enforcement, the FWPA grants freelance workers robust legal remedies for payment violations. Freelancers who experience late or missing payments can file complaints or lawsuits to recover their owed compensation . The penalties for noncompliance are significant – if a hiring party fails to pay within the required timeframe, the freelance worker may be awarded damages up to twice the amount that remained unpaid when payment was due .

Importantly, the law establishes a clear structure for handling payment disputes. Freelance workers in some jurisdictions can file complaints with the appropriate labor department, which then initiates an information facilitation process between the parties . If the hiring entity fails to respond to such complaints, this creates a rebuttable presumption in any civil action that the violations alleged in the complaint occurred .

Beyond this formal process, mediation opportunities may be available if both parties agree . Nevertheless, freelancers retain the right to pursue private legal action if issues remain unresolved .

The FWPA establishes these payment regulations to address a common challenge faced by independent contractors – delayed or unpaid compensation that can create financial vulnerability . Under these regulations, businesses must review and possibly revise their payment practices to ensure compliance and avoid potential legal consequences .

What penalties can hiring parties face under the FWPA?

Penalties for non-compliance serve as enforcement mechanisms within the Freelance Worker Protection Act. Hiring parties who violate FWPA provisions face significant financial consequences through civil actions initiated by freelance workers or public prosecutors.

Failure to provide a written contract

Hiring parties who refuse to provide a written contract when requested by a freelance worker face a statutory penalty of $1,000.00 . This penalty applies regardless of other damages and is added to any unpaid amount calculated at the rate the freelance worker reasonably understood to apply for their services . The penalty creates strong incentives for businesses to formalize their freelance relationships through proper documentation, accordingly protecting freelance workers from verbal agreements that may lead to disputes.

Late or missing payments

Perhaps the most substantial penalties concern payment violations. When hiring parties fail to remit compensation within the timeframe specified in the contract (or within 30 days if no date is specified), freelance workers can seek damages up to twice the amount that remained unpaid when payment was due . This multiplier effectively discourages intentional payment delays and simultaneously compensates freelance workers for the financial hardship created by delayed compensation. Subsequently, these provisions address one of the most common challenges faced by independent professionals.

Other violations of the FWPA

For violations beyond contract and payment requirements, the law establishes additional penalty structures. Essentially, hiring parties who violate any other provision of the FWPA may be subject to damages equal to the value of the contract or the value of the freelance worker's services, whichever is greater . Furthermore, successful civil actions entitle freelance workers to recover reasonable attorneys' fees and costs , making legal action financially feasible for independent contractors with limited resources.

Besides monetary penalties, courts may grant injunctive relief where appropriate , prohibiting hiring parties from continuing problematic practices. Ultimately, these comprehensive enforcement mechanisms establish real consequences for businesses that fail to comply with the FWPA's requirements.

How can businesses comply with the FWPA?

Proactive compliance with the FWPA requires businesses to implement specific procedures before the law takes effect on January 1, 2025. For companies that regularly engage freelance workers, developing standardized practices helps mitigate legal risks while fostering positive contractor relationships.

Identify freelance workers in your contracts

Businesses must first determine which independent contractors qualify as "freelance workers" under the FWPA's definition . This assessment involves reviewing existing vendor relationships to identify individuals providing professional services valued at $250 or more . Companies should examine their current contractor roster, paying special attention to anyone providing creative, technical, or professional services outlined in Labor Code Section 2778(b)(2) .

Use written agreements with required details

Written contracts form the foundation of FWPA compliance. These agreements must include four essential elements: names and mailing addresses of both parties, itemized services with their values and compensation methods, payment dates or determination mechanisms, plus submission deadlines for invoices . Fundamentally, businesses should create template agreements that incorporate all these requirements while allowing customization for specific engagements .

Train staff on FWPA rules

Staff education represents a critical compliance component. Companies must train hiring managers and personnel who engage freelancers on the new requirements . In addition, businesses should update their handbooks and written policies to reflect FWPA provisions . This training should emphasize the importance of documentation, anti-discrimination policies, and timely payment procedures .

Pay freelancers on time

Above all, companies must establish reliable payment systems that align with FWPA timelines. Payments must be made by the date specified in the contract or within 30 days of work completion if no date is specified . Crucially, once work has commenced, businesses cannot require freelancers to accept reduced compensation or perform additional services as conditions for timely payment .

If you need employment litigation, call Setyan Law at (213)-618-3655. Free consultation.