Updated January 26, 2026

How to File a California Wage Claim: Get Your Unpaid Wages Back

Has your employer withheld your hard-earned wages? Filing a California wage claim might be your fastest path to getting paid what you're legally owed.

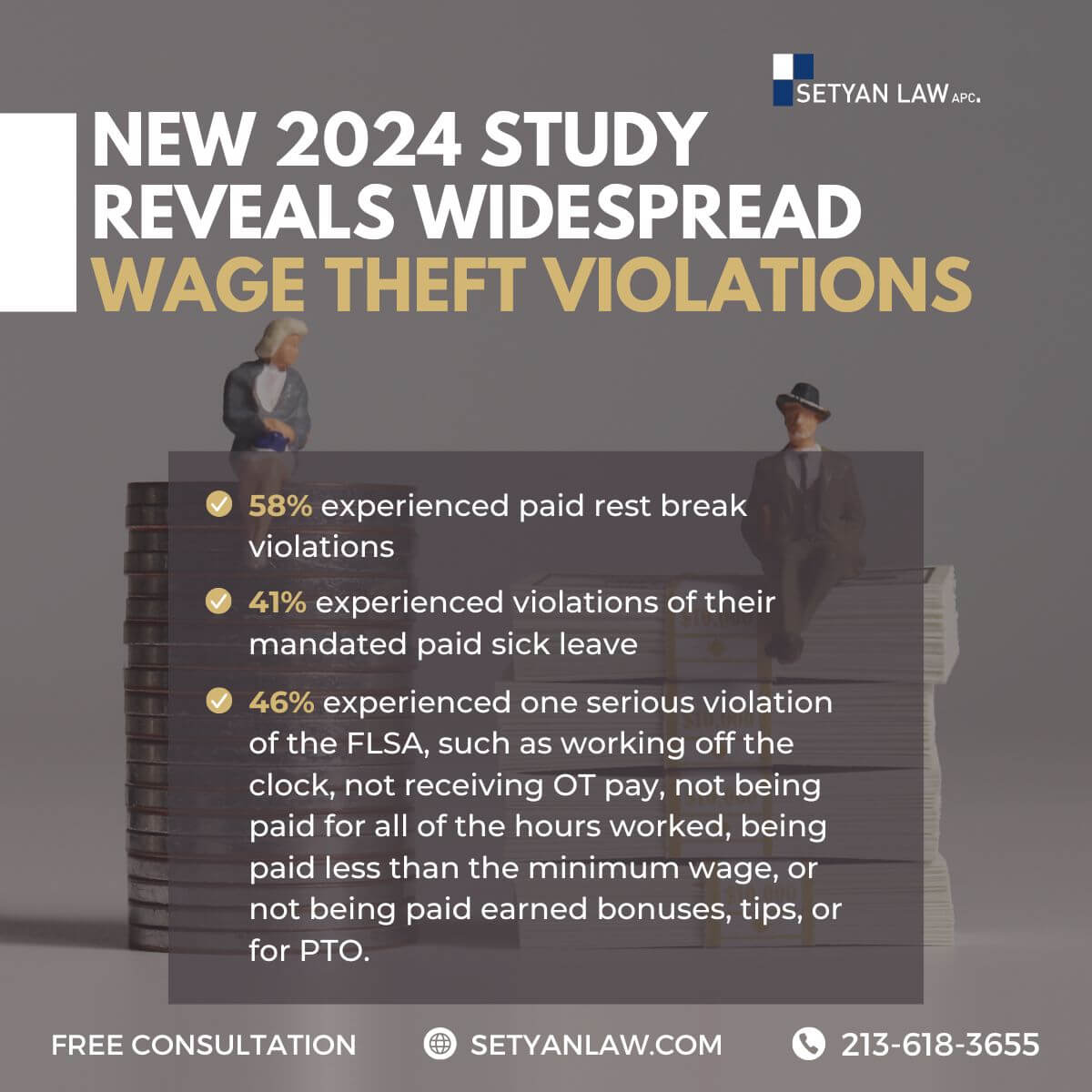

Unfortunately, wage theft affects thousands of California workers each year. From unpaid overtime to missed meal breaks, employers shortchange their workers by millions of dollars annually. Many workers never see this money simply because they don't know how to navigate the claims process.

The good news is that California has some of the strongest worker protection laws in the nation. These laws give you powerful tools to recover unpaid wages, penalties, and interest—often without needing to hire an attorney.

Whether your employer has failed to pay minimum wage, denied overtime, taken illegal deductions, or withheld your final paycheck, you have clear legal rights. Understanding how to properly file your wage claim can make the difference between waiting months (or years) for resolution and getting your money back quickly.

In this step-by-step guide, we'll walk you through exactly how to prepare, file, and win your California wage claim. You'll learn which documentation you need, where to file your claim, and what to expect during the entire process—empowering you to stand up for your rights and recover the wages you've rightfully earned.

Recognize Wage Theft and Know Your Rights

Wage theft occurs whenever employers fail to pay workers what they're legally owed. Before filing a California wage claim, you need to recognize exactly what constitutes wage theft and understand your rights under state law.

Common types of wage violations

Wage theft takes many forms in California workplaces. The most widespread violations include:

- Paying less than minimum wage

- Denying required meal or rest breaks

- Not paying overtime for hours worked beyond regular schedules

- Confiscating or stealing employee tips

- Misclassifying employees as independent contractors

- Forcing employees to work off-the-clock

- Making unauthorized deductions from paychecks

- Not reimbursing necessary business expenses

- Bouncing paychecks or delaying wage payments

- Withholding final paychecks after termination

- Failing to provide paid sick leave

These violations affect workers across all industries but are especially common in food service, construction, hospitality, agriculture, and domestic work . The impact is substantial—Los Angeles workers alone lose approximately $26.20 million weekly from wage theft .

Under California's 2021 law (AB 1003), wage theft exceeding $950 from a single employee or $2,350 from multiple employees within a 12-month period can be prosecuted as grand theft—a felony offense . This means employers can face up to three years in prison along with significant fines.

Who is protected under California law

California labor laws protect all workers regardless of immigration status . This protection extends to employees who might leave California or even the United States—they can still file wage claims with the Labor Commissioner's Office .

The state's worker protections apply to various employment relationships, although independent contractors are generally not covered by the Labor Commissioner's jurisdiction . However, if you believe your employer has misclassified you as an independent contractor to avoid providing basic labor rights, you can still file a wage claim .

As of January 2026, California's minimum wage is $16.90 per hour for all employers, with higher rates for certain industries—fast food workers at chains with 60+ locations nationwide earn $20.00 per hour . Additionally, employers cannot use tips to meet minimum wage requirements, unlike some other states.

Why employers get away with it

Despite California's strong worker protections, wage theft remains widespread for several reasons. First, many employers count on workers' fear of retaliation. Although retaliation is illegal, employers might reduce hours, reassign unfavorable shifts, or even terminate employees who speak up .

Second, wage theft disproportionately affects vulnerable populations, particularly low-wage workers who often lack union representation and fear endangering their livelihoods by objecting . Many affected industries have historically employed immigrant or minority workforces who may be unaware of their rights or hesitant to engage with government agencies.

Third, employers exploit contracting relationships to escape liability. Large companies hire contractors who directly employ workers, allowing the larger firms to avoid legal responsibility for wage violations . Although California has passed laws strengthening worker protections in industries where contracting is common, enforcement challenges persist.

Finally, many employers continue wage theft simply because they can profit from it. Research published in the Review of Accounting Studies found companies are significantly more likely to engage in wage theft when struggling to meet financial goals . This is particularly common in publicly traded companies facing pressure to satisfy stockholders through quarterly earnings reports.

Understanding these patterns helps explain why wage theft remains a persistent problem despite California's progressive labor laws. Consequently, it's crucial for workers to recognize violations and know their rights before filing a California wage claim.

Get Ready: What to Do Before Filing a Claim

Proper preparation is essential before filing your California wage claim. The stronger your documentation, the better your chances of recovering what you're owed. Taking time to organize your evidence, calculate your losses, and understand filing deadlines will substantially improve your likelihood of success.

Gather your pay records and time logs

Documentation forms the foundation of a successful wage claim. Initially, collect all materials that establish your employment relationship and payment history:

- Pay stubs showing your wages, hours worked, and deductions

- Time sheets, cards, or personal records of hours worked

- Employment contracts or offer letters

- Employer information (full name, address, vehicle license plate if necessary)

- Any bounced checks from your employer

- The "Notice to Employee" provided at hiring with your agreed pay rate

- Communications with your employer about wages

Moreover, the California Labor Commissioner's Office recommends tracking all hours worked—including start and end times, meal breaks, and rest periods—even if you're paid by contract or piece rate . This documentation helps prove you were paid less than minimum wage for hours worked. Furthermore, if possible, identify any property your employer owns (buildings, equipment, inventory) which might be used to collect your wages if you win .

Calculate how much you're owed

Once you've gathered your records, determine the exact amount your employer owes you. For minimum wage violations, simply calculate the difference between what you were paid and what you should have received, then multiply by your total hours . For overtime, compute the difference between your regular hourly rate and the time-and-a-half rate (50% above normal pay) .

Subsequently, include other potential violations such as missed rest breaks, meal periods, business expense reimbursements, or unpaid sick leave. Each missed break typically entitles you to one hour's pay as a penalty . Additionally, if your final paycheck was late, you may qualify for "waiting time penalties" equal to your daily wage for each day it was delayed (up to 30 days) .

Understand the statute of limitations

Prior to filing, verify you're within the legal time limits for your specific claim type:

- One year: For bounced check penalties or failure to provide payroll/personnel records

- Two years: For oral promises to pay above minimum wage

- Three years: For minimum wage violations, overtime, meal/rest break violations, sick leave violations, illegal deductions, or unreimbursed business expenses

- Four years: For claims based on written employment contracts

Claims under California's Unfair Competition Law also provide a four-year statute of limitations for many wage violations . Accordingly, it's crucial to file promptly—missing these deadlines can permanently bar recovery of your wages . For ongoing violations like consistently unpaid overtime, the deadline for each instance is calculated separately .

Choose Where to File: State vs. Federal Options

After preparing your documentation and calculating what you're owed, you must decide which agency or court should handle your wage claim. Your choice affects how quickly you'll receive payment, potential recovery amounts, and overall complexity of the process.

When to file with the California Labor Commissioner

The California Labor Commissioner's Office (also called the Division of Labor Standards Enforcement or DLSE) handles most standard wage claims. This option offers several advantages:

- No filing fees

- No attorney required

- Staff familiar with state labor laws

- Protection for all workers regardless of immigration status

Yet this path currently faces significant challenges. Filing with the Labor Commissioner typically takes 3 to 4 years from start to finish due to extreme backlogs . This timeline represents the slowest recovery option despite being the most common choice. The process involves an initial settlement conference followed by a hearing if no agreement is reached.

Remember that the Labor Commissioner only has jurisdiction over employer-employee relationships, not legitimate independent contractors . Nevertheless, if you believe your employer has misclassified you as an independent contractor to avoid providing benefits, you can still file a wage claim .

When to file with the U.S. Department of Labor

Federal filing makes sense primarily in situations where:

- Your employer operates across multiple states

- Your claim involves federal laws like the Fair Labor Standards Act

- State agencies are exceptionally backlogged

- You work in an industry with specific federal protections

The U.S. Department of Labor's Wage and Hour Division handles these claims, which follow a different process than state complaints.

Filing in civil or small claims court

Civil court offers distinct advantages over administrative claims:

- Longer statute of limitations (four years versus three years for Labor Commissioner claims)

- Potential recovery of attorney's fees if you win

- Often faster resolution than the Labor Commissioner process

Small claims court works well for amounts up to $12,500 . The filing fee ranges between $30-$100 depending on your claim amount . Small claims hearings typically occur within 1-2 months after filing .

Key considerations for small claims:

- You cannot have a lawyer represent you during the hearing

- If you initiate the case, you cannot appeal if you lose

- You must collect the judgment yourself if you win

Alternatively, hiring an employment attorney to send a formal demand or file a lawsuit often provides the fastest resolution, sometimes settling cases within 12-18 months . This path signals serious intent and triggers legal risk for employers who might otherwise ignore claims.

File Your Wage Claim Step-by-Step

Once you've decided to pursue a California wage claim, navigating the paperwork and submission process becomes your next challenge. Filing correctly the first time prevents delays and increases your chances of recovering unpaid wages promptly.

How to complete the Initial Report or Claim (Form 1)

To begin with, you'll need to complete DLSE Form 1 (Initial Report or Claim), which serves as the foundation of your wage claim. This form collects essential information about you, your employer, and the specific violations you're claiming. Download it from the Labor Commissioner's website or obtain a copy from your local DLSE office. Be thorough when providing details about your employment relationship and attach any supporting documentation you've gathered. For workers who need language assistance, the form is available in multiple languages, including Spanish, Chinese, Korean, Vietnamese, Tagalog, and Punjabi.

Submitting Form 55 and other attachments

In essence, your claim may require additional forms depending on your situation:

- DLSE Form 55: Required if you worked irregular hours and are claiming unpaid wages or meal/rest period violations

- DLSE Form 155: Needed for commission-related claims

- DLSE Vacation Pay Schedule: Required when seeking vacation wages

Along with these forms, submit copies (not originals) of supporting documents such as time records, pay stubs, bounced checks, and employment information notices. These documents significantly strengthen your claim by providing concrete evidence.

Delivering your claim to the correct DLSE office

Your claim must be filed with the Labor Commissioner's Office that handles wage claims for the location where you performed work. Submitting to the incorrect office can cause months of delay. Undoubtedly, verifying the proper office location is worth the effort. Remember that claims require an original signature and cannot be submitted electronically or by fax—you must mail or deliver them in person.

What to expect after submission

Following submission, the Labor Commissioner typically sends a Notice of Claim Filed to both you and your employer within 2-3 weeks. In most cases, a settlement conference will be scheduled within 3-9 months after filing. Your attendance is absolutely mandatory, or your case will be dismissed. Should no settlement be reached during this conference, a hearing will be scheduled approximately one year to 18 months later. Throughout this process, it's vital to keep the Labor Commissioner updated with any changes to your contact information in writing.

What Happens Next: Hearings, Appeals, and Enforcement

The path to recovering unpaid wages continues after filing with several crucial stages that determine whether you'll collect what you're owed.

The settlement conference process

Following your wage claim submission, the Labor Commissioner typically schedules a settlement conference within 3-9 months. This informal meeting brings both parties together with a deputy labor commissioner who works to resolve the dispute without a formal hearing. Importantly, your attendance is mandatory—your case will be dismissed if you miss this conference without good cause, whereas if your employer fails to appear, your claim will likely proceed to a hearing.

Neither party testifies under oath during this conference, nor are you required to prove your case or bring witnesses. You should, nonetheless, bring copies of documents supporting your position that weren't already submitted with your claim form.

Going to a hearing if no agreement is reached

Should settlement efforts fail, your case moves to a formal hearing, typically scheduled 1-1.5 years after the conference. Unlike the conference, hearings are formal proceedings where:

- You and witnesses testify under oath

- The proceedings are recorded

- You may be represented by an attorney

- You present evidence and cross-examine opposing parties

- You can request subpoenas for witnesses or documents

The hearing officer has wide discretion in accepting evidence and will issue a written decision (Order, Decision or Award) within 15 days after the hearing concludes, explaining the reasons for their decision.

Appealing a decision and collecting your money

Either party may appeal the Labor Commissioner's decision to Superior Court within 10 days of service (15 days if served by mail). This deadline is strictly enforced—courts have consistently rejected late appeals, even when electronic filing errors occur.

For employers appealing, a bond equal to the award amount must be posted with the court. The superior court hears the case "de novo" (as if the DLSE hearing never happened), allowing both parties to present evidence not introduced at the original hearing.

If you win and your employer doesn't appeal or pay, the Labor Commissioner converts the award into a court judgment. These judgments remain valid for 10 years and can be renewed. For collection assistance, you may sign an "Assignment of Judgment" allowing the Labor Commissioner to pursue collection on your behalf.

Conclusion

Filing a California wage claim requires patience and persistence, but stands as your legal right when employers withhold wages you've rightfully earned. Regardless of your immigration status, California law protects you from various forms of wage theft, whether your employer has denied overtime, withheld final paychecks, or failed to provide proper breaks.

Before taking action, gather all relevant documentation and calculate exactly what you're owed. Additionally, consider your filing options carefully. Though the Labor Commissioner's Office handles most claims, significant backlogs mean waiting 3-4 years for resolution. Small claims court offers a faster alternative for claims under $12,500, generally scheduling hearings within 1-2 months after filing.

The entire process demands thoroughness – from completing Form 1 accurately to submitting supporting evidence and attending mandatory settlement conferences. If your case proceeds to a hearing, you must present compelling testimony and evidence under oath.

Above all, remember that wage theft thrives when workers remain silent. Though the process may seem daunting, California provides robust protections for employees seeking their unpaid wages. By understanding your rights and following proper procedures, you significantly increase your chances of recovering what you're legally owed. The path might be long, but justice through a properly filed wage claim remains accessible to all California workers who stand up for their rights.

References

[1] – https://calmatters.org/explainers/when-employers-steal-wages-from-workers/

[4] – https://www.dir.ca.gov/California-Worker/default.html

[5] – https://www.dir.ca.gov/dlse/howtofilewageclaim.htm

[6] – https://www.blairramirezlaw.com/california-workers-rights

[9] – https://www.nolo.com/legal-encyclopedia/whats-your-unpaid-wage-claim-worth-california.html

[17] – https://selfhelp.courts.ca.gov/small-claims-california

Call Setyan Law at (213)-618-3655 to schedule a free consultation.