Updated September 22, 2025

Understanding Overtime and “Double Time” Pay in California

In California, the intricacies of labor laws regarding overtime and double time pay (or time-and-a-half) can be quite complex. As a worker, it’s essential to understand your rights and the regulations that govern your compensation for hours worked beyond the standard workweek. This article will delve into the definitions, eligibility criteria, calculations, and implications of overtime and double time pay, ensuring you are well-informed about your entitlements.

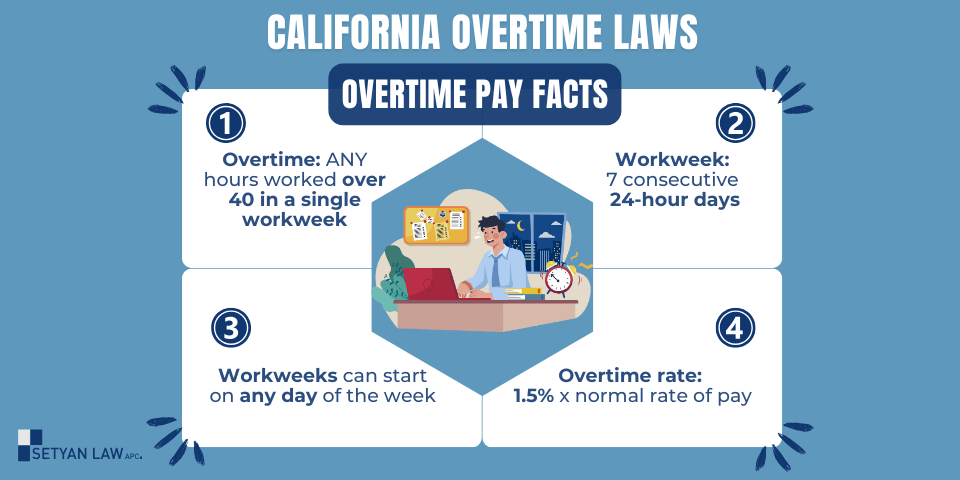

What is Overtime Pay?

Overtime pay refers to the additional compensation that employees receive for hours worked beyond the standard work hours. In California, non-exempt employees are entitled to overtime pay at a rate of 1.5 times their regular hourly wage. This applies under specific conditions:

- Daily Overtime: Employees earn overtime pay for any hours worked over 8 hours in a single workday.

- Weekly Overtime: Employees are also entitled to overtime pay for hours exceeding 40 hours in a workweek.

- Seventh Consecutive Day: If an employee works more than 8 hours on the seventh consecutive day of work, they are entitled to overtime pay for those hours.

Understanding these criteria is crucial for employees to ensure they are compensated fairly for their labor.

What is Double Time Pay?

Double time pay is a higher rate of compensation that applies in specific situations. In California, non-exempt employees qualify for double time pay under the following circumstances:

- Exceeding 12 Hours in a Day: Employees earn double time for every hour worked beyond 12 hours in a single workday.

- Seventh Consecutive Day: If an employee works more than 8 hours on their seventh consecutive workday, they are entitled to double time pay for those additional hours.

Double time pay serves as an incentive for employees who work extensive hours, ensuring they are adequately compensated for their time and effort.

Eligibility for Overtime and Double Time Pay

Understanding who qualifies for overtime and double time pay is essential. In California, the distinction between exempt and non-exempt employees plays a significant role in determining eligibility:

Non-Exempt Employees

Non-exempt employees are those who are entitled to overtime and double time pay. They are typically hourly workers or those whose job duties do not meet specific criteria set by the Fair Labor Standards Act (FLSA) or California labor laws. Common examples include:

- Retail Workers

- Construction Workers

- Hospitality Employees

Exempt Employees

Exempt employees, on the other hand, are not entitled to overtime or double time pay. They typically include salaried employees who meet certain criteria, such as:

- Executive Employees: Those who manage the organization or a department.

- Administrative Employees: Those who perform office or non-manual work directly related to management policies.

- Professional Employees: Those who have advanced knowledge in a field of science or learning.

It’s crucial for employees to understand their classification, as it directly impacts their rights regarding overtime and double time compensation.

Calculating Overtime Pay

Calculating overtime pay in California involves a straightforward formula. Here’s how to determine your overtime compensation:

- Identify Your Regular Hourly Rate: This is the amount you earn for your standard hours worked.

- Calculate Overtime Rate: Multiply your regular hourly rate by 1.5 for overtime hours.

- Determine Total Overtime Hours: Count the number of hours worked beyond the standard work hours (8 hours per day or 40 hours per week).

- Calculate Total Overtime Pay: Multiply the total overtime hours by your overtime rate.

Example Calculation

If an employee earns $20 per hour and works 10 hours in a day, the calculation would be as follows:

- Regular hourly rate: $20

- Overtime rate: $20 x 1.5 = $30

- Overtime hours: 2 (10 hours – 8 hours)

- Total overtime pay: 2 x $30 = $60

Thus, the employee would earn an additional $60 for that day’s overtime.

Calculating Double Time Pay

Double time pay is calculated similarly but at a higher rate. Here’s how to determine your double time compensation:

- Identify Your Regular Hourly Rate: As before, this is your standard pay.

- Calculate Double Time Rate: Multiply your regular hourly rate by 2 for double time hours.

- Determine Total Double Time Hours: Count the hours worked beyond the threshold for double time (12 hours in a day or 8 hours on the seventh consecutive day).

- Calculate Total Double Time Pay: Multiply the total double time hours by your double time rate.

Example Calculation

If the same employee works 14 hours in a day, the calculation would be:

- Regular hourly rate: $20

- Double time rate: $20 x 2 = $40

- Double time hours: 2 (14 hours – 12 hours)

- Total double time pay: 2 x $40 = $80

In this case, the employee would earn an additional $80 for the double time hours worked.

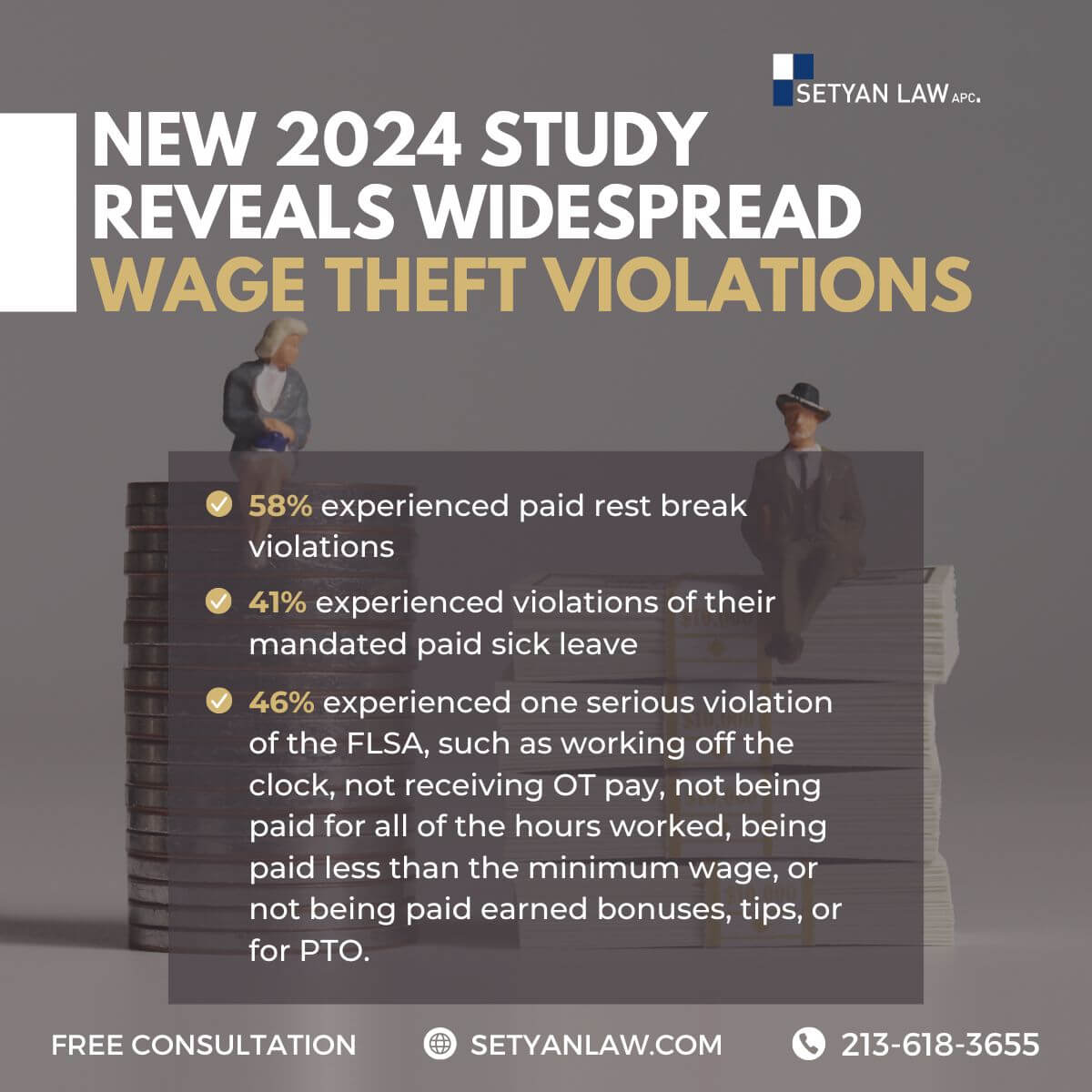

Common Misconceptions About Overtime and Double Time

There are several misconceptions surrounding overtime and double time pay that can lead to confusion among employees. Here are a few clarifications:

- Unauthorized Overtime: Employees are entitled to overtime pay even if they did not receive prior approval from their employer. If the employer knew or should have known that the employee was working overtime, they must compensate them accordingly.

- Exemptions for Certain Industries: Some industries may have specific exemptions or different rules regarding overtime and double time pay. It’s essential to consult the relevant labor laws or a legal expert to understand these nuances.

- Impact of Alternative Workweek Schedules: Employees who agree to alternative workweek schedules may work longer hours without accruing overtime, but they are still entitled to overtime pay if they exceed 40 hours in a week or work beyond the agreed hours.

Employer Responsibilities

Employers have specific responsibilities regarding overtime and double time pay. They must:

- Maintain Accurate Records: Employers are required to keep accurate records of hours worked by employees to ensure proper compensation.

- Inform Employees of Their Rights: Employers should clearly communicate the overtime and double time policies to their employees, ensuring they understand their rights.

- Compensate for All Hours Worked: Employers must pay employees for all hours worked, including overtime and double time, regardless of whether the hours were authorized.

Failure to comply with these responsibilities can lead to legal consequences for employers.

What to Do If You’re Not Paid Overtime or Double Time

If you believe you have not been compensated correctly for overtime or double time hours worked, there are steps you can take:

- Document Your Hours: Keep a detailed record of the hours you worked, including any overtime or double time hours.

- Communicate with Your Employer: Bring the issue to your employer’s attention and discuss your concerns regarding unpaid wages.

- File a Wage Claim: If the issue is not resolved, you can file a wage claim with the California Labor Commissioner’s Office. They will investigate your claim and help you recover any unpaid wages.

- Seek Legal Assistance: If necessary, consult with an employment attorney who can provide guidance and represent you in legal matters related to unpaid wages.

Conclusion

Understanding the nuances of overtime and double time pay in California is crucial for employees to ensure they receive fair compensation for their work. By familiarizing yourself with the eligibility criteria, calculation methods, and your rights, you can advocate for yourself effectively in the workplace. If you encounter issues regarding unpaid wages, don’t hesitate to seek assistance from legal professionals who can help you navigate the complexities of labor laws. Your rights matter, and it’s essential to stand up for them.

References

[1] – https://www.paychex.com/articles/payroll-taxes/whats-the-difference-between-exempt-and-non-exempt-employees

[2] – https://velocityglobal.com/resources/blog/employee-independent-contractor-misclassification-guide/

[3] – https://hr.berkeley.edu/hr-network/central-guide-managing-hr/managing-hr/recruiting-staff/classification/hybrid-jobs

[4] – https://peoplespheres.com/exempt-employees-how-to-classify-them-correctly/

[5] – https://www.getontop.com/blog/how-to-correct-employee-misclassification

[6] – https://www.ccjdigital.com/business/article/14940027/dol-rule-would-stamp-out-gray-areas-in-driver-classification

[7] – https://www.dol.gov/agencies/whd/fact-sheets/17a-overtime

[8] – https://onpay.com/insights/salary-vs-hourly-pay-guide/

[9] – https://www.atsinc.com/blog/careers/salary-vs-hourly-pay-structures-exempt-non-exempt-compensation-explained

[10] – https://www.dol.gov/agencies/whd/overtime

[11] – https://www.investopedia.com/articles/personal-finance/031115/salary-vs-hourly-how-benefits-laws-differ.asp

[12] – https://www.dol.gov/agencies/whd/fact-sheets/17g-overtime-salary

[13] – https://www.law.cornell.edu/cfr/text/29/541.602

[14] – https://www.dol.gov/agencies/whd/overtime/salary-levels

[15] – https://www.bamboohr.com/resources/hr-glossary/duties-test

[16] – https://www.deel.com/blog/employee-misclassification-penalties/

[17] – https://www.tax.virginia.gov/worker-misclassification

[18] – https://www.dol.gov/general/topic/wages/backpay

[19] – https://www.darrow.ai/resources/penalties-for-misclassifying-employees-as-independent-contractors

[20] – https://www.dol.gov/agencies/whd/flsa/misclassification/myths/detail

[21] – https://www.dpeaflcio.org/factsheets/recourse-for-employees-misclassified-as-independent-contractors

[22] – https://www.nolo.com/legal-encyclopedia/what-should-you-do-if-youve-been-misclassified-independent-contractor.html

[23] – https://www.omnipresent.com/articles/how-to-correct-employee-misclassification

Call Setyan Law at (213)-618-3655 to schedule a free consultation.