Updated October 13, 2025

Unpaid Wages in California: Real Settlement Numbers Revealed [2025 Data]

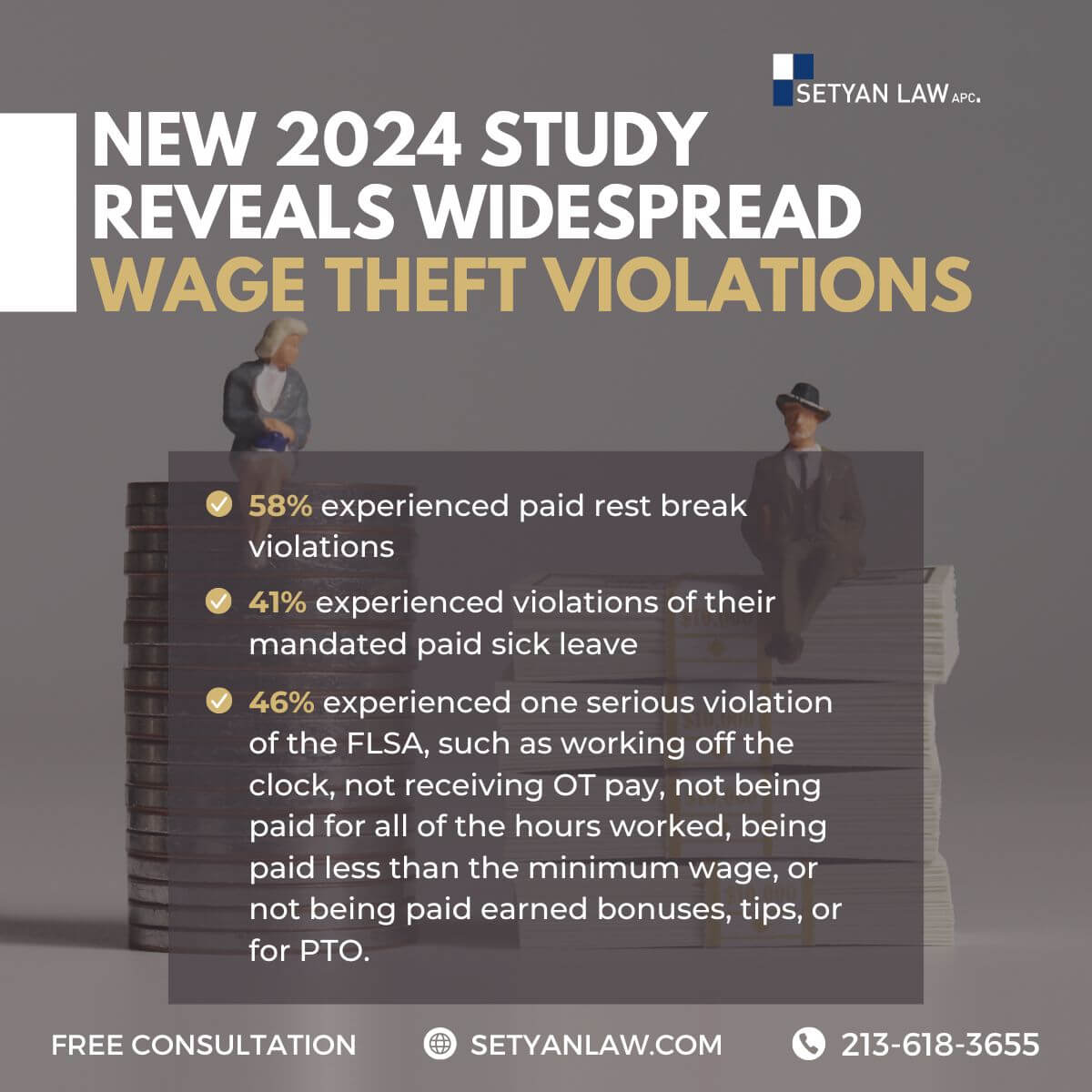

Unpaid wages in California affect thousands of workers every year, with many never receiving the compensation they're legally entitled to. Despite strong labor laws, wage theft continues to be a widespread problem across industries throughout the state.

When employers fail to properly compensate employees, California law provides powerful remedies that can result in substantial settlements. Unfortunately, many workers don't realize the potential value of their unpaid wage claims or how to effectively pursue them.

This article reveals actual settlement numbers from 2025 California wage and hour cases, providing a clear picture of what employees can truly expect when fighting for their rights. From minimum wage violations to missed breaks and overtime disputes, we'll examine real-world payouts ranging from modest four-figure sums to multi-million dollar class action victories.

If your employer has withheld wages, misclassified your position, denied breaks, or failed to pay overtime, understanding these settlement figures is the first step toward securing the compensation you deserve.

What Counts as Unpaid Wages in California

California's labor laws offer some of the strongest worker protections in the nation. Understanding exactly what constitutes unpaid wages helps employees recognize violations and seek proper compensation. The state recognizes several distinct categories of wage theft that employers frequently commit.

Minimum wage violations

Minimum wage violations occur anytime an employer pays less than the legally mandated hourly rate. As of January 2024, California's minimum wage stands at $16.00 per hour [1]. These violations typically happen through:

- Direct underpayment below minimum wage

- Unauthorized deductions from paychecks

- Forcing employees to work "off the books"

The California Labor Commissioner's Office takes these violations seriously, allowing workers to file claims regardless of immigration status [2]. Even seemingly minor underpayments can accumulate significantly over time.

Unpaid overtime and off-the-clock work

California overtime laws are more generous than federal standards. Non-exempt employees must receive overtime pay at 1.5 times their regular rate for:

- Hours worked beyond 8 in a single day

- Hours worked beyond 40 in a workweek

- The first 8 hours worked on the seventh consecutive workday [3]

Additionally, employers must pay double time (twice the regular rate) for hours exceeding 12 in a workday or 8 hours on the seventh consecutive day of a workweek [4].

Off-the-clock work constitutes another serious violation. Under California law, all time spent working must be paid, even if the employer didn't explicitly authorize it but knew or should have known about it [5]. Common examples include:

- Pre-shift preparation or setup

- Post-shift cleanup

- Working through meal breaks

- Administrative tasks after hours

- Training time [6]

Following the landmark Troester v. Starbucks decision in 2018, California law established that employers must compensate workers for all work-related activities, no matter how brief [6].

Missed meal and rest breaks

California employers face substantial consequences for violating meal and rest break requirements. The law mandates:

- A 30-minute unpaid meal break for shifts exceeding 5 hours

- A 10-minute paid rest break for every 4 hours worked [7]

For each workday an employer fails to provide these breaks, the employee is entitled to one additional hour of pay at their regular rate as "premium pay" [8]. Furthermore, a California Court of Appeal ruling in United Parcel Service v. Superior Court of Los Angeles County clarified that employers owe two separate premiums for missed meal and rest breaks that occur on the same day [7].

The premium pay obligation extends to missed "recovery periods" as well. A recovery period refers to a cool-down period of at least 5 minutes that employers must provide to employees working outdoors [9].

Misclassification of employees

Misclassification occurs when employers improperly label workers as independent contractors rather than employees [10]. This practice allows employers to avoid:

- Payroll taxes

- Minimum wage requirements

- Overtime obligations

- Meal and rest break provisions

- Paid sick leave requirements

- Workers' compensation coverage [10]

California's strict "ABC test" makes misclassification harder for employers. To legally classify someone as an independent contractor, the employer must prove the worker: (1) is free from company control, (2) performs work outside the company's usual business, and (3) has an independently established occupation in that field [11].

Penalties for willful misclassification range from $5,000 to $15,000 per violation, increasing to $10,000-$25,000 per violation for pattern or practice violations [11]. Misclassified employees can recover all unpaid wages, premium pay for missed breaks, and business expense reimbursements.

Real Settlement Numbers: What the Data Shows in 2025

The financial reality of wage theft cases often remains shrouded in mystery for most California workers. Yet understanding actual settlement figures provides crucial insight for employees considering legal action against employers who've withheld their rightful compensation.

Low-end settlements: $6,000–$50,000

Small-scale wage violations typically result in settlements ranging from $6,000 to $50,000 [12]. These cases generally involve shorter periods of wage theft or fewer affected employees. According to recent data, the majority of low-end settlements involve:

- Minimum wage violations averaging $10,000–$25,000 [13]

- Unpaid overtime claims settling for $15,000–$50,000 [13]

- Missed meal and rest break cases yielding $2,500–$10,000 [13]

These figures represent the starting point for wage claim resolutions, typically concerning violations that occurred over limited timeframes or affected individual workers rather than groups. Moreover, cases with minimal documentation or where violations weren't clearly established tend to fall within this range.

Mid-range settlements: $50,000–$300,000

Cases of moderate complexity or involving systematic wage violations over extended periods generally secure settlements between $50,000 and $300,000 [12]. These mid-tier settlements often stem from situations where employers habitually denied proper compensation through multiple forms of wage theft.

A notable example is the Z & Y Restaurant settlement in San Francisco, where workers received an average of approximately $73,000 each [14]. This 2021 case resulted from an investigation that uncovered unpaid minimum wages, overtime, split shift premiums, and misappropriated tips.

The California top settlements list for 2021 shows numerous cases concluding exactly at the $300,000 mark, including actions against Cold Storage Manufacturing, Ochoa Striping Service, and San Marcos Growers [15]. These cases typically involved class actions addressing unfair competition and intentional wage violations.

High-value settlements: $300,000+

Complex wage theft cases, particularly those involving numerous employees or egregious violations, frequently reach settlements exceeding $300,000 [12]. In fact, the most complex cases can yield between $100,000 and $2,000,000+ [16].

Several landmark cases demonstrate the potential scale of these settlements:

- A California oil refinery paid $15.25 million in 2021 to hourly shift workers denied rest breaks and accurate wage statements [16]

- A national retail chain settled for $3.2 million after failing to pay workers for mandatory security checks [17]

- A technology company agreed to $800,000 for timekeeper rounding system violations [16]

- A transportation company paid $2.8 million in a class action for various wage and hour violations [16]

These substantial settlements generally reflect cases involving systematic, willful violations affecting large groups of employees over extended periods.

Class action vs individual case payouts

While class actions often generate headline-grabbing total settlement figures, individual payouts can vary significantly. Consequently, it's impossible to estimate exact payments for class members without considering case specifics [18].

Individual wage claims can sometimes yield substantial compensation without class action involvement. For instance, one individual settlement for wage theft reached $400,000 [12], while a whistleblower retaliation case involving missed lunch breaks resulted in a $135,000 payout for a worker earning just $17 per hour [12].

Class actions distribute settlements among all affected employees, whereas individual claims concentrate compensation on a single plaintiff. Nevertheless, both approaches can include payments for backpay, unpaid wages, overtime, punitive damages, and emotional distress compensation [18].

The average settlement across all California wage cases typically falls between $25,000 and $100,000, though the median usually lands in the $40,000-$75,000 range [13]. However, each case's unique circumstances ultimately determine its settlement value.

Key Factors That Influence Settlement Amounts

Several crucial factors determine how much compensation workers receive in unpaid wage settlements in California. Understanding these elements helps both employees and employers accurately assess potential claim values.

Length of wage violations

The duration of wage violations directly impacts settlement amounts. Initially, cases spanning months or years receive substantially larger settlements than those covering only weeks [1]. In California, workers typically recover 15% of wages owed through the Division of Labor Standards Enforcement (DLSE) [19]. Violations extending over several years can dramatically increase claim values, especially in cases involving systematic wage theft.

Severity and type of violation

Not all wage violations carry equal weight. Cases involving:

- Willful violations that extend the recovery period from two to three years [20]

- Multiple concurrent violations (overtime, meal breaks, minimum wage) [16]

- Liquidated damages that can double the settlement amount [20]

Typically yield higher settlements. For example, minimum wage violations cost California workers approximately $2 billion annually [2], with individual workers losing an average of $2,634 per year [19]. Penalties for wage theft can exceed actual unpaid wages, particularly when violations are willful or repeated.

Employer size and industry

Large employers typically pay higher settlements than small businesses [21]. Workers moving from small to large companies see wage increases of approximately 35% [21], which subsequently affects settlement calculations. Industry also matters—sectors with widespread violations such as retail, food service, construction, and hospitality often face heightened scrutiny [2], potentially resulting in larger settlements when violations occur.

Employee classification status

Misclassification substantially impacts settlement amounts. The U.S. Department of Labor collected $234 million in 2021 for FLSA violations [22], with many cases stemming from employee misclassification. Misclassified workers can recover:

- Unpaid minimum wages and overtime

- Premium pay for missed breaks

- Business expense reimbursements [23]

Plus additional penalties ranging from $5,000 to $25,000 per violation in cases of willful or pattern misclassification [23].

Strength of documentation and evidence

Perhaps most critically, documentation quality often determines settlement outcomes. Workers with comprehensive records of hours worked, communications about wages, and company policies have significantly stronger claims [24]. Proper evidence includes time sheets, pay stubs, employment contracts, witness statements, and correspondence with management [24]. Unfortunately, approximately 70% of Los Angeles workers lose wage claims due to insufficient documentation [25].

The Wisconsin wage lien program demonstrates the power of proper evidence—workers there recover 25% of owed wages, which is 1.5 times more than in California [19], primarily due to stronger documentation requirements.

How to Prove Wage and Hour Violations

Proving wage violations requires solid evidence, as California courts place the burden of proof on employees making claims. Fortunately, even when employers keep poor records, workers can still build compelling cases with proper documentation.

Collecting pay stubs and time records

The foundation of any unpaid wage claim starts with thorough personal recordkeeping. Under California law, employers must maintain accurate records, but workers should independently track their hours as a safeguard. Workers should:

- Track daily start and end times, including meal and rest breaks

- Keep all pay stubs and compare them with personal time records

- Document any discrepancies between hours worked and wages paid

- Save all electronic time records from employer systems

The California Labor Commissioner specifically states that workers filing claims aren't required to keep their own records, yet having personal documentation significantly strengthens cases [26]. Most importantly, these records establish a pattern of underpayment that's difficult for employers to dispute.

Using witness statements

Witness testimony often provides crucial support for wage claims, primarily when multiple employees experience similar violations. Former coworkers can verify patterns of off-the-clock work, missed breaks, or other violations that might otherwise be difficult to prove [27]. In some cases, when several employees report identical violations, these collective accounts can create sufficient evidence to establish a claim even without extensive documentation.

Emails and internal communications

Digital evidence has become increasingly valuable in wage theft cases. Communications from supervisors requesting early arrival, late stays, or work during breaks serve as powerful proof of employer expectations [3]. Prior to leaving a job, workers should secure copies of relevant emails, texts, and other digital communications, as access to company accounts typically ends upon departure.

Company policies and handbooks

Official company documents often contradict actual workplace practices. Employee handbooks, written policies about overtime, or commission agreements that detail payment terms can establish what compensation should have been provided [4]. These documents help demonstrate when employer practices violate their own stated policies.

Bank records and payment history

Bank statements showing consistent deposit amounts regardless of varying hours worked often reveal underpayment patterns [3]. When comparing bank records against time records, discrepancies become apparent. Under California law, the burden shifts to employers when they fail to maintain accurate records—allowing workers to rely on reasonable estimates of time worked and wages owed [28].

Real Case Examples from California Courts

Recent court settlements reveal the substantial financial consequences employers face when violating California wage laws. These landmark cases illustrate how wage theft litigation can result in substantial payouts across various industries.

Tesoro oil refinery: $15.25 million

Tesoro Refining and Marketing LLC agreed to pay $15.25 million to settle claims from 1,400 unionized operators at its Martinez and Wilmington oil refineries [29]. The workers alleged they never received proper rest periods because they were constantly required to be on call with radios during breaks. Each worker received approximately $8,012 from the settlement, with $3.8 million allocated for attorney's fees [29]. Essentially, the case highlighted how "on-call" rest periods violate California labor laws.

Retail chain: $3.2 million

Home Depot settled a class action lawsuit for $72.5 million covering over 272,000 California employees who alleged various wage violations [30]. The settlement primarily addressed employees who worked closing shifts and were forced to wait off the clock after stores were locked. Additionally, the settlement covered workers who weren't paid for time spent collecting and putting on aprons, plus those who lost pay due to rounded clock-in and clock-out times [30].

Tech company timekeeping: $800,000

UKG paid $3.36 million to resolve claims that its timekeeping software violated Illinois biometric laws [5]. The settlement benefited individuals who used UltiPro TimeBase, TouchBase, or NOVAtime time clocks between 2015 and 2021. Namely, the company failed to meet disclosure and consent requirements for biometric data collection. Individual payments were estimated between $200 and $400 [5].

Transportation company: $2.8 million

The U.S. Department of Labor obtained an injunction against Cargomatic Inc., a transportation company that retaliated against drivers seeking unpaid wages [6]. The company had threatened to countersue drivers for over $150,000 in attorney's fees after they filed wage violation claims [6]. Undeniably, such retaliatory tactics are illegal under federal labor laws, as employers cannot shift liability for wage violations onto workers through contract clauses.

Conclusion

Unpaid wages remain a significant problem throughout California, affecting workers across numerous industries. California laws clearly protect employees from wage theft, yet thousands still face violations ranging from minimum wage underpayment to missed breaks and misclassification.

The settlement data from 2025 reveals substantial compensation possibilities for affected workers. Small-scale violations typically yield $6,000-$50,000, while systematic wage theft over extended periods can result in mid-range settlements between $50,000-$300,000. Large-scale class actions or particularly egregious cases often exceed $300,000, with some reaching multi-million dollar figures.

Several key factors determine final settlement amounts. The duration of violations dramatically impacts compensation, with years-long infractions resulting in significantly larger payouts than short-term issues. Additionally, the type and severity of violations play crucial roles, particularly when employers willfully disregard labor laws. Company size, industry standards, and employee classification further influence potential settlements.

Strong documentation stands as perhaps the most critical element in securing fair compensation. Workers who maintain personal time records, preserve communications about work expectations, and collect witness statements position themselves for successful claims. Without such evidence, approximately 70% of Los Angeles workers lose wage claims despite valid grievances.

The landmark cases against major employers demonstrate that California courts take wage theft seriously. From the $15.25 million Tesoro settlement for denied rest breaks to the $3.2 million retail chain payout for off-the-clock work, these examples showcase the substantial consequences employers face for violations.

Though wage theft persists throughout California, workers armed with knowledge about their rights and proper documentation can effectively fight back. Understanding the true value of wage claims empowers employees to pursue rightful compensation rather than accepting losses. Undoubtedly, the settlement figures revealed here underscore both the seriousness of wage violations and the meaningful remedies available under California law.

References

[1] – https://www.weisbergcummings.com/employment-claims/wage-claims-lawyers/how-much-is-my-case-worth/

[2] – https://lawcollective.com/unpaid-wages-in-california/

[3] – https://www.hornwright.com/employment-law/unpaid-wages/evidence-needed-for-unpaid-wage-claims/

[4] – https://www.rmlegalgroup.com/what-evidence-do-you-need-for-an-unpaid-wage-lawsuit/

[5] – https://topclassactions.com/lawsuit-settlements/closed-settlements/ukg-biometric-violations-3-3m-class-action-settlement/

[6] – https://www.dol.gov/newsroom/releases/sol/sol20240930

[7] – https://www.calchamber.com/california-labor-law/meal-and-rest-breaks

[8] – https://www.dir.ca.gov/dlse/faq_mealperiods.htm

[9] – https://www.cdflaborlaw.com/blog/new-california-law-expands-missed-meal-and-rest-period-premium-pay-to-misse

[10] – https://www.dir.ca.gov/fraud_prevention/Misclassification.htm

[11] – https://www.rhdtlaw.com/practice-areas/employee-misclassification/

[12] – https://manukyanlawfirm.com/california-unpaid-wages-average-settlement/

[13] – https://scherandbassett.com/average-settlement-unpaid-wages-california/

[14] – https://www.dir.ca.gov/DIRNews/2021/2021-83.html

[15] – https://topverdict.com/lists/2021/california/top-100-wage-hour-violation-settlements

[16] – https://www.lawlinq.com/average-settlement-for-unpaid-wages/

[17] – https://www.kingsleykingsley.com/average-settlement-in-california

[18] – https://www.jimenezloayza.com/blog/california-employment-class-action-lawsuits/

[19] – https://www.nelp.org/insights-research/hollow-victories-the-crisis-in-collecting-unpaid-wages-for-californias-workers/

[20] – https://www.employmentlawinsights.com/2025/07/no-longer-doubling-down-dol-will-not-seek-liquidated-damages-in-wage-claims-before-suit/

[21] – https://www.sciencedirect.com/science/article/pii/S0927537198000062

[22] – https://www.venable.com/insights/publications/2022/02/flsa-misclassification-common-mistakes-that

[23] – https://www.skassellaw.com/understanding-the-impacts-of-misclassification-on-employers-and-employees-a-comprehensive-overview/

[24] – https://shavitzlaw.com/the-role-of-documentation-in-wage-claims/

[25] – https://msdlawyers.com/why-do-70-of-los-angeles-workers-lose-their-wage-claims-due-to-missing-documentation/

[26] – https://www.dir.ca.gov/dlse/howtofilewageclaim.htm

[27] – https://stratejicrelationships.com/articles/winning-wage-and-hour-cases-with-insider-witness-support

[28] – https://brobertsonlaw.com/should-you-keep-emails-paystubs-documents-if-you-believe-your-boss-isnt-paying-you-properly/

[29] – https://topclassactions.com/lawsuit-settlements/employment-labor/california-employee-break-laws-tesoro-to-pay-15-million-to-settle-lawsuit/

[30] – https://mnklawyers.com/home-depot-agrees-to-pay-72-5-million-to-settle-california-wage-action/

Call Setyan Law at (213)-618-3655 to schedule a free consultation.