Updated April 11, 2025

Understanding California Labor Laws

California employees have the right to be paid in full and on time. It is crucial for both employers and employees to understand the obligations and rights when it comes to wages. This article aims to provide a comprehensive overview of California labor laws regarding the payment of wages, including late or withheld pay. By delving into the relevant statutes and regulations, we can shed light on the legal framework that governs wage payments in California.

Understanding Wage Obligations in California

California law defines wages as payment for labor performed by an employee, encompassing various forms of compensation such as hourly pay, fixed salaries, commissions, piece-rate payments, and other payments tied to specific projects or tasks. It is important to note that wages also include benefits received by employees as part of their compensation, such as money, room, board, vacation pay, and sick pay.

Under California labor laws, an employer has a legal obligation to pay employees the wages they have earned. This obligation arises from two sources: contract law and the California Labor Code. When an employee accepts employment at a promised wage, a binding agreement is established between the employer and the employee. This agreement can be in the form of a written contract or an oral agreement.

Moreover, the California Labor Code provides specific rights to employees when it comes to earning certain wages, such as minimum wage or overtime wages, under the appropriate circumstances. In cases where California law grants employees the right to receive a minimum wage or overtime pay, any employment contract that provides for a lesser wage is not valid or enforceable.

Prohibited Deductions from Wages

In California, employers are generally prohibited from making deductions from an employee’s wages unless authorized by state or federal law or when expressly authorized in writing by the employee. Deductions that are required by law include income taxes and garnishments. Additionally, deductions for insurance premiums, benefit plan contributions, or other authorized deductions that do not amount to a rebate on the employee’s wages are allowed with the employee’s written consent.

However, there are limitations on an employer’s ability to make deductions from an employee’s wages for certain circumstances. For instance, deductions for cash shortages, breakage, or loss of equipment are specifically regulated by the Industrial Welfare Commission Orders and are limited by court decisions. Employers are generally not allowed to make deductions for such losses unless they can demonstrate that the loss resulted from the employee’s dishonesty, willful act, or gross negligence.

Unlawful Payroll Deductions

Certain payroll deductions are considered unlawful under California labor laws. Employers are prohibited from collecting or receiving any gratuity given or left for an employee, nor can they deduct any amount from wages due to an employee based on gratuities. However, a restaurant may have a policy allowing for tip pooling or sharing among employees who provide direct table service to customers.

If an employer requires an applicant or employee to provide a photograph or a bond, the employer must bear the cost of these requirements. Similarly, if an employer requires employees to wear a uniform, the employer must cover the cost of the uniform. Employees are entitled to be reimbursed by their employers for any business expenses or losses incurred in the direct consequence of their work duties.

Additionally, employers are not allowed to withhold or deduct from an employee’s wages for pre-employment medical or physical examinations required as a condition of employment. Any medical or physical examination required by federal or state law or local ordinance must not be a financial burden on the employee.

Payday Requirements in California

California labor laws specify the timing and frequency of wage payments. In most cases, employees must be paid at least twice a month. The employer must establish regular paydays before wages are first paid and must post a notice specifying the regular paydays and the time and place of payment. If employees are paid on a semimonthly basis, wages earned between the 1st and 15th day of the month must be paid between the 16th and 26th day of the same month. Wages earned between the 16th and the last day of the month must be paid between the 1st and 10th day of the following month.

Alternative pay schedules are also allowed, such as weekly or biweekly payments. In these cases, employers must generally pay wages no later than seven days after the end of each work period. Wages for overtime earned during a work period must be paid not later than the regular payday for the next work period. However, certain exempt employees, such as those in administrative, executive, or professional positions, may be paid once a month, provided that the payment is made on or before the 26th of the month and includes wages for the entire month.

Final Paychecks and Vacation Pay

When an employment relationship ends, California labor laws mandate that employees receive their final paychecks in a timely manner. If an employee is fired, they must be paid all unpaid wages, including any earned up to and including the termination date, on the same day they are terminated. However, there are exceptions to this rule depending on the industry in which the employee is employed.

If an employee quits and provides at least 72 hours’ notice, their final wages must be paid on their last day of work. For employees who quit without giving such notice, their final wages must be paid within 72 hours after their last day of work. Paid vacation is considered a form of wages in California, and when employment is terminated, employees are entitled to be paid for any unused vacation time that has vested.

It is important to note that employers cannot condition entitlement to vacation pay on the completion of a fixed period of work. Even if an employment agreement states that employees are not entitled to vacation pay until they have worked for a full year, they must still be compensated for any unused paid vacation in proportion to the time they have worked before the employment ends.

Penalties for Late or Withheld Wages

In cases where employers fail to pay wages on time or withhold wages, California labor laws provide for penalties to hold employers accountable. If an employer fails to pay wages on time, they may be subject to a late payment penalty. The penalty for an initial violation is $100 for each failure to pay each employee, while subsequent violations or willful/intentional violations can lead to a penalty of $200 per failure to pay each employee, plus 25% of the unlawfully withheld wages.

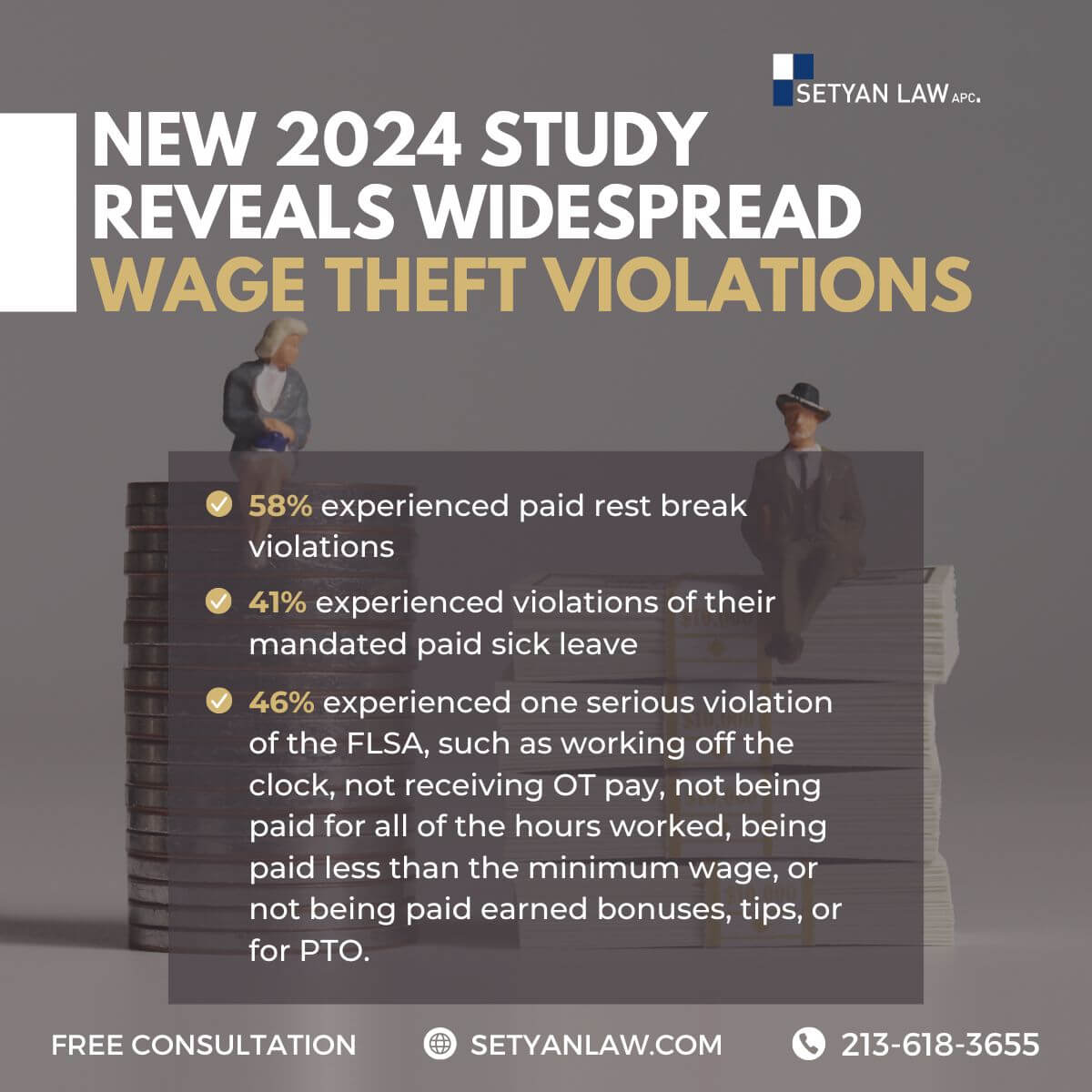

Employees who experience late or withheld wages have several options for recourse. They can file a wage claim with the Labor Commissioner’s Office to request statutory penalties that go directly to the employee. Alternatively, they can file a Report of Labor Law Violation for widespread violations affecting a group of workers, which may result in civil penalties imposed on the employer by the state.

Employees who face discrimination or retaliation for asserting their rights, such as complaining about late or unpaid wages, can file a discrimination/retaliation complaint with the Labor Commissioner’s Office. Employers found guilty of discrimination or retaliation may face additional consequences and penalties.

Taking Action for Unlawful Wage Deductions

If an employer makes an unlawful deduction from an employee’s paycheck, the employee has options for seeking resolution. One option is to file a wage claim with the Division of Labor Standards Enforcement (DLSE), also known as the Labor Commissioner’s Office. The DLSE will assess the claim and may proceed with a conference or hearing to determine its validity and explore the possibility of resolving the dispute.

If the claim is not resolved at the conference, the matter may proceed to a hearing or be dismissed for lack of evidence. After the hearing, an Order, Decision, or Award (ODA) will be issued by the Labor Commissioner. Either party involved can appeal the ODA to a civil court, where the case will be heard and decided independently of the Labor Commissioner’s hearing.

If an employee prevails at the hearing and the employer fails to pay the ODA or appeal it, the ODA can be entered as a judgment against the employer. This judgment carries the same weight as any other money judgment entered by a court. The employee can then pursue the collection of the judgment or assign it to the DLSE for collection.

Conclusion

Understanding California labor laws regarding the payment of wages is essential for both employers and employees. Employers must fulfill their legal obligation to pay employees on time and in full, while employees should be aware of their rights and avenues for recourse if their wages are late or withheld unlawfully. By adhering to the provisions set forth in the California Labor Code, employers can ensure compliance and maintain a fair and equitable work environment for their employees. Likewise, employees can take action by hiring a lawyer to protect their rights and seek redress for any violations they may experience.

Consulting a Los Angeles labor attorney will provide you with the necessary guidance and support to navigate the legal process effectively. If you’ve been denied your rights as an employee by your employer, time is of the essence, please seek legal advice promptly to maximize your chances of a successful outcome.

Call Setyan Law at (213)-618-3655 for a consultation.